How to Improve Sales Team Performance: A Founder-Level Guide

February 2, 2026

If you're trying to fix sales team performance, stop looking at your reps and start looking at your go-to-market system.

I’ve seen this pattern across dozens of SaaS companies: a founder’s first instinct is to blame the people. But the hard truth I’ve learned scaling B2B SaaS companies is that high-performing teams are built on a foundation of sharp positioning, qualified pipeline, and aligned marketing. They are not built on motivational speeches or last-minute SPIFs.

Underperformance is almost always a system problem, not a people problem.

Your Sales Performance Problem Is a System Problem

When revenue numbers dip, the founder's playbook is predictable. They question the team's skill, motivation, or hunger. This leads to a cycle of pep talks, redundant training, and incentive programs that treat symptoms, not the disease.

It’s a fundamental misdiagnosis.

In B2B SaaS, chronic underperformance is rarely a 'people problem.' It's a system problem. Even the best salesperson can't consistently sell a poorly positioned product to the wrong audience. Pushing your reps harder when the system is broken is like flooring the accelerator with the parking brake on—you’ll generate heat and noise, but no forward motion.

The real root causes are systemic, buried deep within your go-to-market engine. It’s time to inspect the machine.

Systemic vs. Symptomatic Sales Problems

Founders often get stuck treating symptoms because they feel more immediate. It’s easier to question a rep’s work ethic than to admit the company’s positioning might be flawed. This table breaks down common symptoms and their true systemic causes to help you shift your focus.

The pattern is clear. Flawed responses are quick fixes aimed at individuals. Effective responses require a deeper, strategic look at the entire system. That’s where sustainable improvement is found.

Misaligned Inputs, Predictable Failures

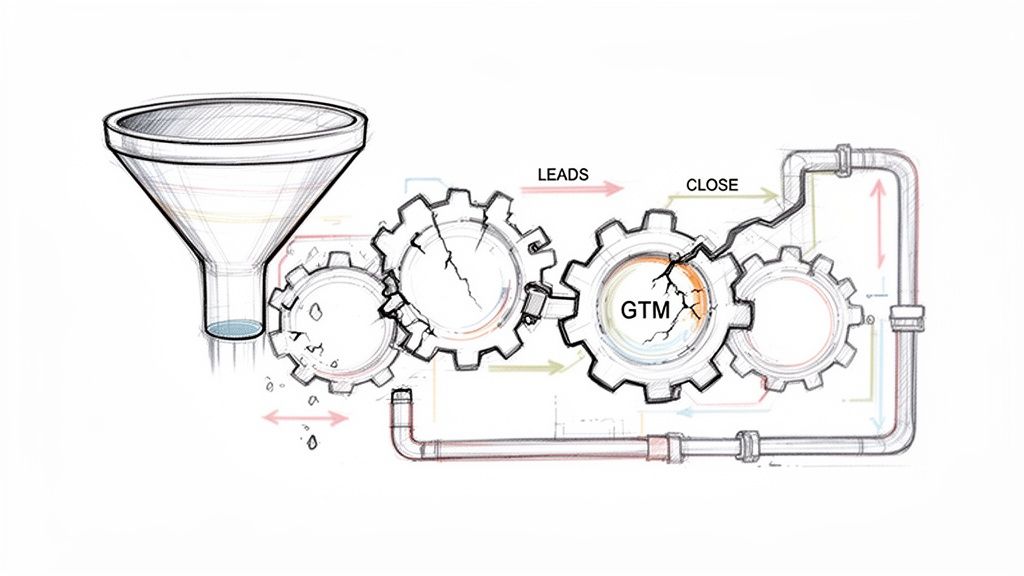

Think of your sales team as the final gear in a complex machine. When that gear grinds to a halt, the failure is almost always upstream. To diagnose the problem correctly, you must analyze the inputs your reps work with, not just their outputs.

Here are the most common failure points I observe:

- Weak Positioning: If marketing can't clearly articulate a differentiated value proposition, your reps are forced to become product marketers on every call. They become expensive, inconsistent messengers instead of expert closers.

- Poor-Fit Pipeline: When demand generation is optimized for volume over quality, the pipeline gets flooded with low-intent, non-ICP leads. Reps burn cycles on prospects who were never going to buy, which kills morale and efficiency.

- Broken Handoffs: The chasm between a Marketing Qualified Lead (MQL) and a Sales Qualified Lead (SQL) is where revenue goes to die. Without clear definitions and a robust process, good leads die from neglect or improper follow-up.

These are not sales skill issues. They are strategic GTM flaws that manifest at the end of the line as "poor sales performance."

A Data-Driven Reality Check

The market is unforgiving of inefficiency. High-performing B2B SaaS teams consistently achieve 20%+ year-over-year growth not by cracking the whip, but by obsessing over funnel efficiency and maintaining tight sales-marketing alignment.

With customer acquisition costs rising and retention becoming more difficult, pipeline velocity is a necessity, not a luxury.

Your sales compensation plan cannot fix a broken value proposition. A new CRM will not solve a pipeline quality crisis. Stop applying symptomatic cures to systemic diseases.

To truly improve sales team performance, you have to stop tweaking the dashboard and start inspecting the engine. This means shifting focus from individual rep activity to the health of the entire lead-to-close process. The goal is to find and fix the highest-leverage points within that system.

The rest of this guide explains how.

Conducting a Brutally Honest Sales Performance Audit

Before you can fix anything, you need an objective map of reality. Most founders and sales leaders believe their CRM dashboard provides this, but they’re usually just looking at lagging indicators like quota attainment. That's like looking at the scoreboard after the game—it tells you if you won or lost, but not why.

A real sales performance audit isn’t about glancing at dashboards. It's about dissecting the entire journey from lead creation to closed-won with surgical precision. You must get past surface-level numbers to understand the true health of your funnel, stage by stage.

This process separates professional operators from amateurs. It replaces vague feelings of underperformance with a prioritized list of weaknesses, so you can focus your efforts where they will actually make a difference.

Deconstruct Your Funnel Metrics

Your first job is to isolate every potential point of failure. Stop looking at the overall funnel conversion rate; it’s a vanity metric that hides the real problems. Instead, break down your analysis into these critical areas.

1. Stage-to-Stage Conversion Rates

This is the most fundamental diagnostic you can run. You must know the percentage of opportunities that successfully move from one stage to the next. No excuses.

- Lead to MQL: What percentage of inbound leads meet your basic marketing qualification criteria? A low number here signals a top-of-funnel targeting or messaging problem.

- MQL to SQL/Meeting Booked: How many qualified leads does your sales team accept and convert into meetings? This is a notorious black hole where revenue disappears.

- SQL to Discovery/Demo: Of the meetings booked, how many progress to a real discovery call or product demo? A significant drop-off here often signals poor qualification by SDRs or a weak opening from your AEs.

- Discovery to Proposal/Trial: How many demos or discovery calls result in a proposal or trial? Failure at this stage means your value prop isn't connecting with the prospect's pain.

- Proposal to Closed-Won: What’s your ultimate close rate on qualified, late-stage opportunities?

Analyzing these rates individually tells you exactly where your deals are stalling. For instance, a high MQL-to-SQL rate but a low Discovery-to-Proposal rate suggests your SDRs are effective at booking meetings, but your AEs are failing to build value during the demo.

Isolate Your Velocity and Stagnation Points

Conversion rates tell you if deals are moving, but velocity metrics tell you how fast. A slow sales cycle is a silent killer of your unit economics. You must measure the average time deals spend in each stage.

Where do deals sit the longest before they die? You’ll often find opportunities stagnating for weeks in stages like "Proposal Sent" or "Negotiation." This isn't a closing problem; it’s a failure to establish urgency and a clear business case earlier in the process. Your audit must flag any stage where the average duration is longer than acceptable for your market.

A deal that sits in one stage for more than 30 days is not a "slow-moving opportunity." It's a dead deal your rep is afraid to close-lost. Your audit must expose this pipeline padding.

In B2B SaaS, the MQL-to-SQL conversion rate is often the biggest bottleneck, hovering at a dismal 15-21% on average. Improving this single stage by just 5 percentage points can lift overall revenue by up to 18%. It is a massive point of leverage.

Ask Unflinching Questions of Your Data

Once you have the numbers, you must interpret them without bias. This is where most leaders stumble; they see the data through the lens of what they want to be true. To see clearly, start by asking these questions.

- Is our problem at the top, middle, or bottom of the funnel? Low Lead-to-MQL rates point to a marketing or ICP problem. Low MQL-to-SQL rates mean you have a broken handoff. Low Proposal-to-Close rates indicate an issue with your value proposition or closing skills.

- Are our stage definitions clear and objective? If reps can move a deal to the "Proposal" stage without sending a proposal, your data is garbage. Enforce strict, non-negotiable exit criteria for every stage.

- How does performance vary by lead source or rep? Segmenting your data can reveal powerful truths. You might find that one marketing channel produces leads with a sales cycle twice as long as another, or that one rep excels at discovery but fumbles the close. This allows for laser-focused coaching and strategic adjustments. You can dive deeper into this with our guide on how to improve your sales conversion rate.

This audit isn't a one-time event. It’s a continuous diagnostic process. By committing to this level of analytical rigor, you move from guessing about performance issues to knowing exactly where your GTM engine is broken and how to fix it.

Building Sales Enablement as a GTM Function

Most B2B SaaS companies get sales enablement catastrophically wrong. They treat it like an HR onboarding task: new reps get access to a shared drive of stale battlecards and product specs that nobody ever looks at again. This isn't just ineffective; it's a massive strategic failure.

High-growth teams understand that enablement isn't a one-time event. It's a continuous, strategic go-to-market function that directly fuels the pipeline. It is the connective tissue between product marketing and quota-carrying reps, the mechanism that translates high-level strategy into tactical advantages on live deals.

When reps underperform, the problem is rarely a lack of product knowledge. The real gaps—the ones that kill deals—are almost always in messaging confidence, inconsistent skill application, and poor process discipline. A real enablement function fixes these systematically.

The Three Pillars of Effective Enablement

To build a true enablement engine, you need to focus on three core pillars. Neglect one, and the system fails. The goal is to create a system that reps pull from because it demonstrably helps them win, not one that marketing pushes on them.

1. Messaging and Positioning Assets

This is about arming your team with more than a list of features. It’s about codifying the why—why we win, why our prospects care, and how we're different in a way that matters in a sales conversation. The assets must be practical and instantly usable.

Most battlecards, for instance, are terrible. They're defensive and internally focused. A good one is offensive; it frames the conversation on your terms and gives the rep tools to disqualify competitors on their own turf.

Here's a simple litmus test for any enablement asset: Would your top-performing rep voluntarily use this in front of a high-value prospect? If the answer is no, it's not good enough. Rebuild it.

2. Continuous Skill Development

Onboarding is not training. True skill development is an ongoing process, relentlessly focused on the specific behaviors that move deals forward. This goes beyond product demos and into the core competencies of B2B sales.

The data is staggering. Only 18% of buyers believe salespeople are well-prepared for their meetings. Yet, teams that prioritize continuous training see a 353% ROI and 19% higher win rates. Your program must zero in on the most common skill gaps: objection handling (47%) and discovery questioning (42%).

3. Process Reinforcement

Excellent assets and sharp skills are wasted in a chaotic process. Enablement’s job here is to ensure the "rules of the road" are clear, logical, and consistently followed. This isn't micromanagement; it's about reducing friction and building a predictable revenue engine.

This includes:

- Clear Stage Definitions: What are the non-negotiable exit criteria for each stage in your CRM?

- Rules of Engagement: Who owns what lead, and for how long? No ambiguity.

- CRM Hygiene: Mandating the specific fields that must be updated for a deal to progress.

Without this structure, the data from your sales audit becomes unreliable. Coaching conversations lose their impact because you and your reps aren't operating from the same reality.

Building an Enablement Engine That Works

To move from a folder of forgotten PDFs to a true GTM function, you must operationalize these pillars.

Start by looking at the results from your sales audit and identify the single biggest bottleneck. Is it your MQL-to-SQL conversion rate? The demo-to-proposal rate? Pick one.

Focus your first enablement "sprint" entirely on that single problem.

For example, if your demos aren't converting, don't create another product feature deck. Instead, run workshops on discovery call techniques. Record actual calls, review them as a team, and build a playbook around the exact questions your best reps ask to uncover deep-seated pain.

Distill that playbook into a one-page "Discovery Call Guide" and put it directly into the workflow. Finally, measure the impact on your demo-to-proposal conversion rate over the next 30 days.

This is how you build an enablement function that drives revenue. It's not about the volume of content produced; it’s about the targeted impact on specific, measurable performance gaps. It's a continuous loop: diagnose a problem, develop a focused intervention, and measure the results. You can learn more in our guide to sales enablement best practices.

Designing Compensation Plans That Drive Strategy

Your sales compensation plan is not an HR document. It is the most powerful strategic tool you have for communicating what you value. Too many B2B SaaS startups miss this, defaulting to a lazy and dangerous model: a simple commission percentage on total contract value.

This is a profound mistake. It pays for the wrong actions at scale.

When you only reward the top-line number, you implicitly tell your team it's acceptable to close bad-fit customers. You encourage deep discounts to get deals over the line. You motivate sandbagging to smooth out paychecks. You pay them to hit a number, and they will—often at the expense of your company's long-term health.

The goal isn't just to reward reps for closing deals. It's to reward them for closing the right deals—the ones that build a healthy, sustainable business with high net revenue retention.

Moving Beyond the Simple Commission

An intelligent compensation plan is a finely tuned instrument, not a blunt object. It aligns individual financial incentives with your most critical business goals. If your strategy is to move upmarket, increase contract length, or land more ICP customers, your comp plan must reflect that.

Instead of a flat percentage, a modern SaaS comp plan uses strategic levers to guide behavior. These components separate a high-performance plan from one that encourages chaos:

- Multi-Year Kickers: Pay a higher commission rate for the second and third years of a contract, especially if paid upfront. This directly incentivizes reps to push for longer-term commitments, improving cash flow and customer lifetime value (LTV).

- Ideal Customer Profile (ICP) Bonuses: Attach a significant bonus for closing deals that perfectly match your validated ICP criteria. This makes it financially painful for a rep to waste time on a poor-fit lead, even if it seems like an easy win.

- Product Mix Accelerators: If you’re launching a new product or want to drive adoption of a high-margin module, pay an accelerated commission rate on that specific line item. This tells the team exactly where to focus.

- Clawbacks on Early Churn: Implement a policy where reps pay back a portion of their commission if a customer churns within the first 6 or 12 months. This creates powerful accountability for deal quality and ensures reps have skin in the game for customer success, not just the initial close.

These are not complicated ideas. They are surgical adjustments that turn your comp plan into a guidance system for your go-to-market strategy.

The table below contrasts the old way of thinking with a smarter, behavior-driven approach.

Modern B2B SaaS Comp Plan Levers

Ultimately, a modern comp plan pays for the right results in the right way.

Aligning Incentives with Reality

Building a smarter plan starts with asking the right questions. Your current plan is already generating behaviors, whether you designed it to or not. Diagnose what those behaviors are and see if they align with your business goals.

Your sales reps are rational economic actors. They will always optimize their behavior to maximize their earnings under the rules you give them. If your rules are simplistic, their behavior will be too.

Think about your company's top three strategic priorities for the next 12 months. Is it reducing churn? Increasing average contract value (ACV)? Breaking into a new vertical?

Now, look at your current compensation plan. Does it actively support those goals? Or does it passively reward behaviors that might work against them? If you need to improve financial predictability, rewarding multi-year deals is critical. You can get more insights on this by understanding the fundamentals of what revenue forecasting is and how it ties to sales incentives.

Designing your compensation plan is an exercise in strategic clarity. It forces you to be brutally honest about what you want your sales team to achieve. Get this right, and you create an engine where every rep is financially motivated to build a healthier, more predictable business—not just a bigger one.

A 90-Day Plan to Systematically Improve Performance

Insight without execution is a waste of time. Audits and frameworks mean nothing until you turn them into a concrete plan of attack. This is where you translate diagnosis into momentum.

Most leaders fail here. They find a dozen problems and try to fix everything at once. That path leads to initiative fatigue, frustrated reps, and zero meaningful change.

A smarter approach is a phased, 90-day sprint. It’s a tactical plan designed to build on itself, delivering measurable wins in a single business quarter. You force focus, achieve quick wins to build belief, and then lock in the systemic changes that will last.

Days 1-30: Diagnosis and Quick Wins

The first month is about getting a clear baseline and tackling low-hanging fruit—the problems with the highest leverage and least effort to fix. Your goal is to stop the bleeding and prove change is possible. Momentum is everything.

- Complete the Performance Audit: This is non-negotiable. Use the framework from the previous section to get an honest map of reality. Pinpoint your single biggest conversion bottleneck. This becomes your primary target for the entire 90 days.

- Fix Critical Messaging Gaps: Your audit will likely show that reps are struggling to articulate your value prop. Don't build a massive new playbook yet. Instead, create a one-page "messaging cheat sheet" with three bullet points: the core pain you solve, your key differentiator, and a killer customer proof point. Get this to the team immediately.

- Establish Baseline Metrics: On Day 1, freeze your core funnel metrics (MQL-to-SQL, Demo-to-Proposal, etc.). This is the benchmark you will measure all progress against.

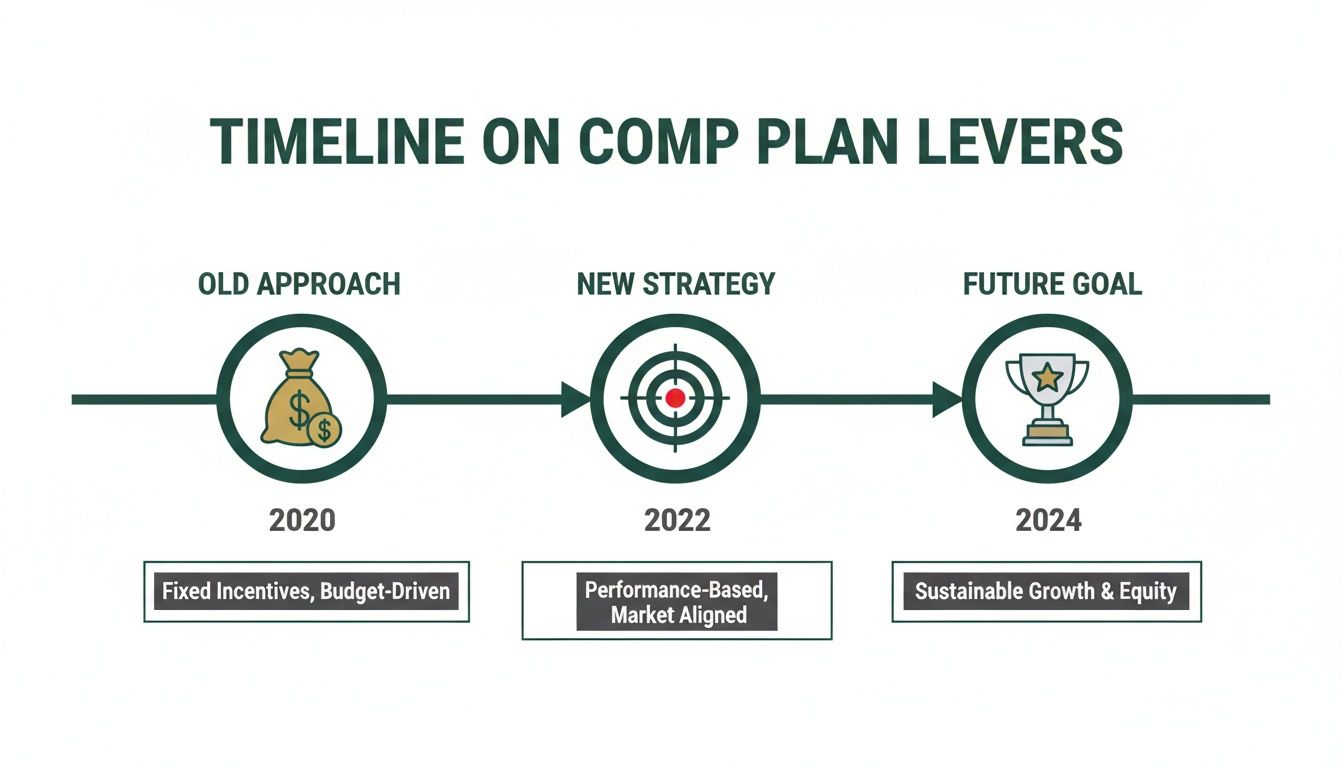

This timeline shows how a company might evolve its compensation strategy over time, shifting from simple incentives to a model that drives sustainable growth. It's an example of the kind of phased, strategic thinking you'll apply in this 90-day plan.

The progression is clear: from rewarding any deal to incentivizing the right deals, which has a massive impact on the long-term health of the business.

Days 31-60: System Implementation

With a clear diagnosis and early momentum, month two is for rolling out the core systems that drive lasting change. This is where you move from quick fixes to durable infrastructure.

Your focus shifts to deploying the revised assets and processes that address the root causes found in month one. This isn't just about handing the team new tools; it's about fundamentally changing how they operate.

The goal of this phase isn't perfection; it's adoption. A 70% complete playbook that the team actually uses is infinitely more valuable than a 100% perfect one that sits in a folder.

Here’s what you should be focused on now:

- Roll Out Enablement v1.0: Based on your audit, launch the first version of your new enablement assets. If demos are the problem, this means a new pitch deck and a certification program. If it's qualification, you roll out a new discovery call script. For more on this, see our in-depth sales playbook template.

- Launch Targeted Coaching: Your audit exposed specific skill gaps; now attack them. Run weekly coaching sessions focused only on that one skill, using real call recordings for review.

- Adjust CRM Workflows: Enforce the new, objective stage-exit criteria in your CRM. Make it impossible for reps to advance a deal without completing the required fields. This cleans your data and reinforces the right behaviors.

Days 61-90: Reinforcement and Optimization

The final month is about making the new systems stick and measuring their impact. Here, you shift from actively managing the change to observing results and making small tweaks.

Relentlessly reinforce the new behaviors until they become muscle memory. In weekly deal reviews, explicitly ask reps how they used the new playbook or messaging. Publicly praise those who adopt the new system—make them the heroes.

For reps who are struggling to adapt, a more formal approach might be needed. You can learn how to craft a robust and effective Performance Improvement Plan that gives them a clear path forward.

Finally, measure your leading indicators. Have your MQL-to-SQL rates improved? Is your demo-to-proposal rate ticking up? These are the early signals that your 90-day plan is working, long before you see the impact on lagging revenue numbers. This data is the fuel for your next 90-day sprint.

Founder FAQs on Sales Performance

After working with dozens of B2B SaaS founders, the same questions come up when performance dips. Here are direct, unflinching answers.

What Is the Biggest Mistake Founders Make When Trying to Improve Sales Team Performance?

Misdiagnosing a systemic problem as a people problem. Founders see a missed quota and immediately jump to conclusions about rep motivation or skill. They treat the symptom, not the disease.

The real issue is almost always upstream: weak positioning, an unclear ICP polluting the pipeline with bad-fit leads, or a value proposition that doesn't resonate in a live sales call.

A great salesperson cannot consistently sell a poorly positioned product to the wrong audience. Before you blame your reps, audit your entire go-to-market strategy.

Firing a rep and hiring a new one into a broken system just restarts the clock on failure. It’s an expensive, morale-killing cycle that avoids the real work of fixing your GTM fundamentals. The problem isn't the gear; it's the machine.

How Long Does It Take to See Results from New Sales Enablement?

Track two types of results on two different timelines.

Leading Indicators (30-45 Days):

These are early signals that your new assets and training are having an effect. You should see improvement here within a month.

- Higher MQL-to-SQL Conversion: More marketing leads are accepted by sales and converted into meetings.

- Increased Demo-to-Proposal Rate: Discovery calls and demos are more effectively creating qualified pipeline.

- Improved Rep Confidence: You'll hear it in call reviews; reps are more articulate and handle objections with more precision.

Lagging Indicators (One Full Sales Cycle):

These are the bottom-line business outcomes. They naturally take longer to show up, often 60-120 days or more depending on your average deal cycle.

- Shorter Average Sales Cycle: Deals move through the funnel faster.

- Higher Overall Win Rate: You close a greater percentage of qualified opportunities.

- Increased Average Contract Value (ACV): Reps are better equipped to sell value and defend against discounting.

If you see no improvement in leading indicators after 45 days, the initiative has likely failed to address the core problem. Re-diagnose.

Should I Fire My Lowest Performing Sales Reps?

Not immediately. Firing a rep is often a sign of a leadership failure in hiring, onboarding, or coaching. Pulling the trigger too quickly is a costly reaction that solves nothing.

First, use the audit framework in this guide to determine if the rep is a victim of a broken system.

- Is their territory viable compared to top performers?

- Are the leads they're receiving of comparable quality?

- Are they receiving consistent, actionable coaching, or just pressure to "hit the numbers"?

If the system is fair, the next step is a formal Performance Improvement Plan (PIP). This is not a formality before termination; it's a genuine attempt to salvage the investment you've made in them. The PIP must have clear, measurable activity and outcome goals over 30-60 days.

If the rep fails to meet the PIP goals despite clear support and a fair system, then it's time to part ways. But firing without first examining your own systems is just swapping out parts in a machine designed to fail.

At Big Moves Marketing, we help B2B SaaS founders diagnose these systemic issues and build the go-to-market engine that drives predictable revenue. If you're tired of treating symptoms and want to fix the root cause of underperformance, let's talk. Learn more at https://www.bigmoves.marketing.

%20-%20Alternate.svg)

%20-%20white.svg)