What Is Revenue Forecasting A Founder's Guide To B2B Growth

At its core, revenue forecasting is your business's financial roadmap—an educated prediction of how much money you’ll generate over a specific period. Think of it as the strategic compass guiding every critical decision you make, from hiring your next account executive to funding a new marketing campaign.

What Is Revenue Forecasting Really About?

Imagine a pilot trying to fly from New York to London. She wouldn't just point the plane east and hope for the best. She’d have a detailed flight plan mapping out the route, fuel needs, and altitude. A revenue forecast does the same thing for your B2B company, plotting the financial course you need to take to hit major milestones like profitability or your next funding round.

This process is so much more than a simple accounting task. For a B2B founder, understanding what is revenue forecasting is really about gaining a firm grip on your company’s journey, turning raw ambition into a plan you can actually measure and execute.

A solid forecast is made up of several key inputs and outputs. Understanding these components is the first step toward building a model you can trust.

Table: Core Components of a B2B Revenue Forecast

Each of these pieces fits together like a puzzle, giving you a comprehensive view of where your revenue is headed and why. It’s this combination of internal data and external context that makes a forecast so powerful.

From Guesswork to Strategic Direction

Without a forecast, too many B2B companies operate reactively, making huge calls based on gut feelings or whatever cash is in the bank that day. That’s a recipe for poor outcomes. Forecasting gives you the framework to stop reacting and start operating proactively.

It empowers you by answering the tough, foundational questions that shape your entire growth strategy:

- Can we actually afford to hire two new salespeople next quarter?

- How much runway do we have if the market takes a downturn?

- Based on our pipeline, what ARR can we realistically promise the board?

Making this shift from pure guesswork to data-informed direction is what separates the companies that just survive from the ones that truly scale.

Revenue forecasting is the bridge between your company's vision and its day-to-day operational reality. It translates your big goals into a set of numbers and timelines that the entire team can rally around.

The Challenge of Accuracy

Creating a forecast that holds up is notoriously difficult. A 2023 survey revealed that a staggering 80% of sales organizations miss their revenue forecasts by 25% or more, which highlights just how complex modern B2B sales cycles have become. You can dig into more of these insights about forecasting accuracy over at Metronome.

This is exactly why a thoughtful, well-built model is so critical. A forecast isn't about gazing into a perfect crystal ball. It’s about building a realistic, defensible plan based on the best data you have right now. It gives you a baseline to measure performance against, helping you spot when things are going off the rails early enough to actually do something about it.

Why Accurate Forecasting Drives Sustainable Growth

A revenue forecast is more than just numbers on a spreadsheet. It’s the closest thing a B2B founder has to a crystal ball. It’s the critical difference between constantly reacting to problems and proactively shaping your company’s future.

This predictive clarity gives you the confidence to make the bold moves that actually lead to growth. It turns abstract goals into concrete operational plans, letting you lead with conviction instead of just gut feeling. When you have a solid handle on your financial trajectory, every major decision becomes less of a gamble and more of a calculated step forward.

Make Smarter Resource Decisions

Picture this: you have enough cash to either greenlight a significant marketing campaign or hire two new software engineers. Which one do you choose? Without a reliable forecast, you're essentially guessing, basing a critical decision on your current bank balance—a notoriously risky way to run a business.

A solid forecast, on the other hand, gives you a data-backed framework for that decision.

You can see the projected impact of a new hire on your burn rate and runway. You can model how a marketing campaign might influence lead velocity and, eventually, new MRR. This foresight ensures you’re putting capital where it will generate the highest return, preventing costly mistakes that can kill your momentum.

“Forecasting isn't about predicting the future with perfect accuracy. It's about building a framework that allows you to make better decisions today in the face of an uncertain tomorrow.”

This structured approach is the heart of effective financial planning, linking strategic forecasting and budgeting directly to your company's real-world growth ambitions.

Build Unshakeable Investor Confidence

Investors don’t just put their money into a great product; they invest in a predictable business. When you walk into a due diligence meeting with a well-grounded forecast, you’re not just sharing numbers—you’re demonstrating complete command over your business.

A credible forecast proves you understand the nuts and bolts of your operation: your sales cycle, customer acquisition costs, and churn rates. It shifts the conversation from a tense interrogation to a collaborative discussion about scaling. Investors see you’ve done the hard work, which makes them far more confident in your ability to execute the plan and deliver returns. This command of your numbers is crucial no matter where you are on your journey, defining how you navigate the various company growth stages B2B businesses face.

Create an Early Warning System

Finally, and maybe most importantly, a forecast is your best early warning system. Business rarely goes exactly as planned. A key go-to-market strategy might fall flat, or a new market entrant could suddenly disrupt your sales process.

By regularly comparing your actual results to your forecast, you can spot negative trends long before they become full-blown crises.

- Is churn creeping up higher than projected? You can jump on customer satisfaction issues immediately.

- Is the sales pipeline velocity slowing down? You can work with your sales leader to diagnose the bottleneck.

- Are marketing leads not converting as expected? You can pivot your campaign strategy before burning through more budget.

This ability to spot deviations early lets you make agile adjustments, steering the ship back on course instead of discovering you're miles off track when it's already too late. It’s this kind of proactive leadership that fuels true, long-term success.

Choosing The Right Forecasting Model For Your B2B Business

Picking a forecasting model is like choosing the right tool for a job. You wouldn’t use a sledgehammer to hang a picture. The same logic applies here. You don’t need a hyper-complex, AI-driven model when you’re just starting out, and you shouldn’t rely on a simple projection when you have years of rich sales data.

The trick is to match the model to where your company is right now—your stage, your data maturity, and your operational reality. For early-stage companies, the goal is simplicity and direction. You just need a North Star to guide you, not a detailed astrological chart.

The Straight-Line Model: Your Starting Point

For most B2B startups fresh out of the gate, the straight-line method is the go-to. It’s exactly what it sounds like: a simple, straightforward approach that takes your recent growth rate and projects it forward in a straight line.

Let's say your company just hit $1.2M ARR and you’ve been growing at a steady 8% month-over-month. Applying that rate forward gives you a forecast of roughly $2.5–$2.7M ARR for the next 12 months. When historical data is thin, this method gives you a quick, easy-to-understand baseline to work from. To see how different models fit various stages, you can check out these forecasting insights from Metronome.

The Pipeline-Based Model: Gauging Your Sales Engine

As your sales motion gets more sophisticated, you need a model that actually reflects what's happening in your funnel. This is where pipeline-based forecasting comes in. Think of it like a factory assembly line—you know the raw materials going in and your historical output, so you can make a good prediction about the finished goods coming out.

This model shifts the focus from simple historical growth to your active sales pipeline. Mature sales teams often layer this on top of other methods for a much clearer picture.

For instance, if your sales team has an average win rate of 20% and your average deal is worth $40,000, then a qualified pipeline of $2M logically supports a forecast of $400,000 in new ARR over the next sales cycle. It's a far more granular and realistic view of what your team can actually deliver. To get a better handle on this, take a look at our guide to building a powerful B2B sales pipeline.

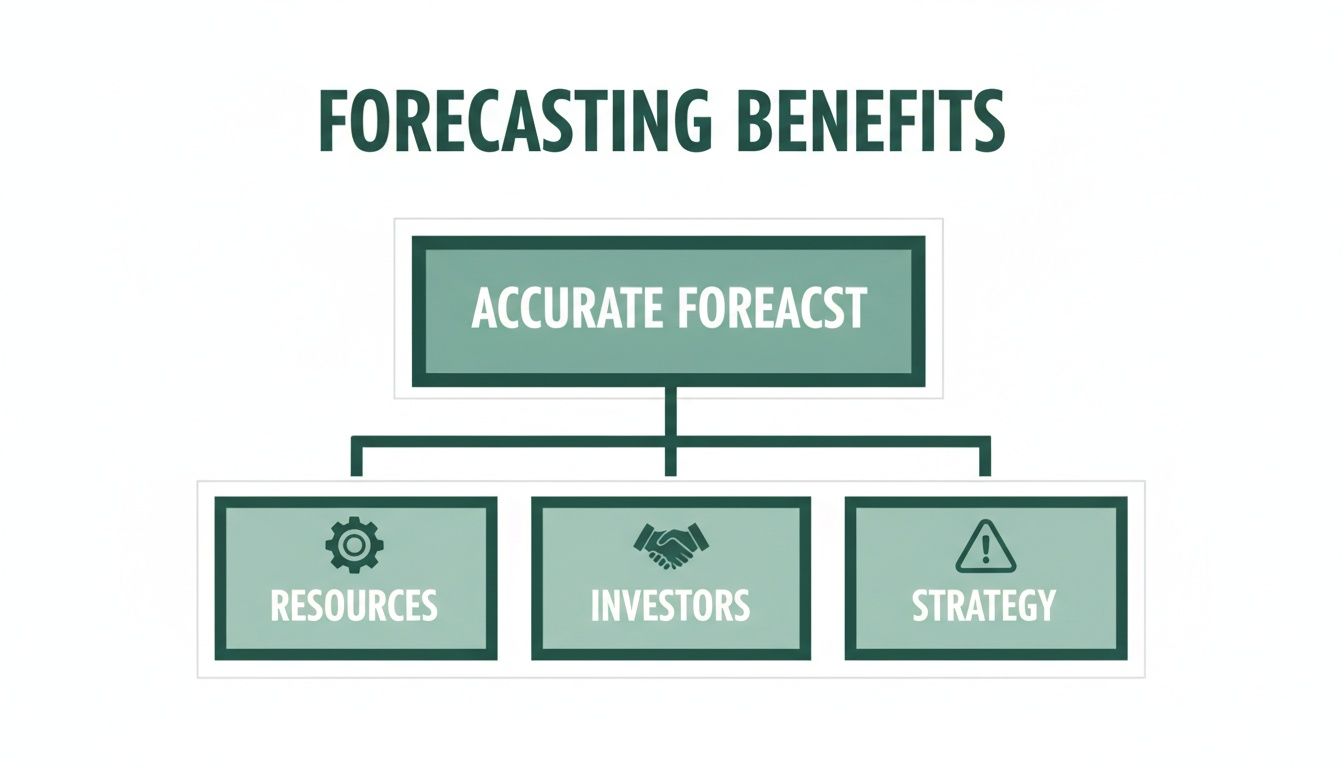

The image below breaks down how getting this right—with the right model—has a ripple effect across the entire business, influencing everything from resource planning to investor confidence.

A trustworthy forecast isn't just a number; it's the foundation for making smart decisions and building the external confidence you need to grow.

Advanced Models For Scale and Precision

Once you’ve been operating for a few years and have a solid bank of historical data, you can graduate to more powerful and precise models.

Time-Series Analysis: This model is smart enough to spot recurring patterns in your data, like seasonality. It knows your Q4 sales always increase because of end-of-year budget approvals, and it adjusts the forecast to reflect that reality.

AI-Driven Models: This is the top tier of forecasting. AI and machine learning algorithms can dig through massive datasets—CRM data, deal velocity, even the sentiment in sales call transcripts—to find subtle patterns that a human analyst would almost certainly miss.

To help you figure out which model makes sense for your stage, here's a quick comparison.

Choosing Your B2B Forecasting Model

Ultimately, there's no single "best" model—only the one that's best for you right now.

Choosing your model is a journey. Start simple, embrace more complexity as your company and your data mature, and always let your available data be your guide. The goal isn't just to produce a number, but to build a believable story about where your company is headed.

How AI Is Reshaping Revenue Intelligence

The days of wrestling with static spreadsheets for your revenue forecast are over. A massive shift is underway, moving us from clunky, manual processes to dynamic, AI-driven revenue intelligence. For B2B founders, this isn't just a minor tech upgrade; it’s a new way to see—and shape—your company's financial future.

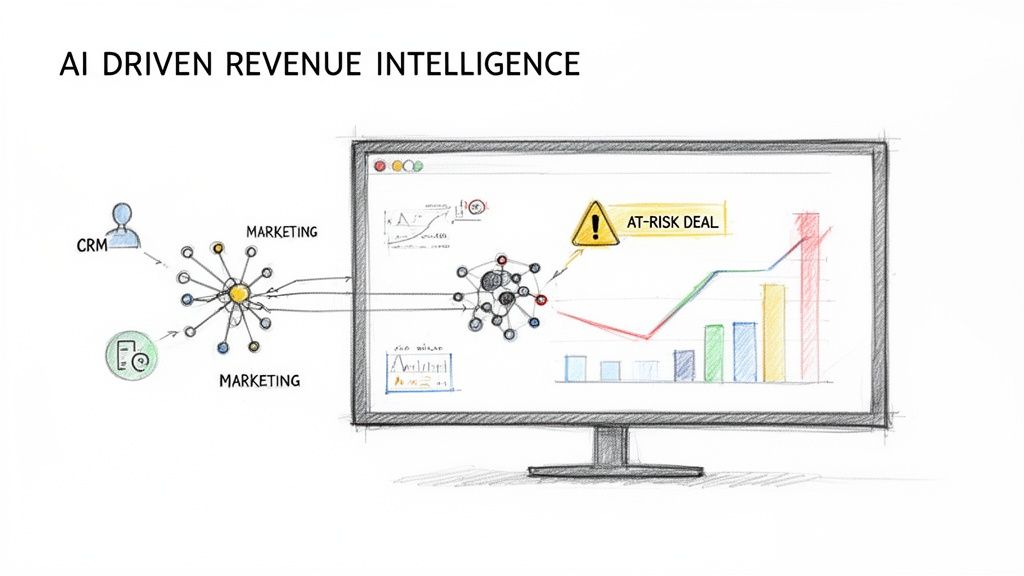

Think of modern revenue intelligence platforms as the central nervous system for your business. They connect to everything—your CRM, marketing automation, even product analytics—and create a forecast that’s constantly learning and adjusting in real time.

For a founder, this translates into real-world advantages that were pure science fiction just a few years ago.

From Historical Report to Strategic Tool

In the old world, a forecast was a historical document. It told you where you had been. AI turns it into a forward-looking tool, showing you where you’re going and, more importantly, what moves to make right now.

It’s about surfacing the "unknown unknowns" that a human could never spot.

Imagine getting an automated alert that a high-value deal is at risk because email engagement from the key decision-maker dropped by 50% last week. Or discovering that leads from a specific marketing channel close 22% faster and have a much higher lifetime value.

This is the kind of insight that’s now available, letting you shift from passively watching the numbers to proactively shaping them. This same tech is also changing how investors operate, as detailed in this piece on how AI is reshaping VC.

The core promise of AI in forecasting is to replace gut feelings with data-driven signals. It helps you see around corners and make decisions based on probabilities, not just past performance.

This shift is creating significant market momentum. The revenue intelligence market, supercharged by AI, is projected to grow from USD 3.83 billion in 2024 to a massive USD 10.70 billion by 2033.

The Power of Predictive Scenarios

Perhaps the most powerful application of AI here is the ability to run endless 'what-if' scenarios in seconds. Forget spending hours tweaking formulas in a spreadsheet. Now you can ask the big questions and get immediate, data-backed answers.

- What happens to our year-end ARR if we boost our marketing budget by 15% next quarter?

- How will a 10-day delay in our average sales cycle hit our cash flow in six months?

- If we hire two new account executives, what’s the most likely impact on new bookings by Q4?

This capability transforms your forecast from a static report into an interactive sandbox for strategic planning. It gives you the power to test your assumptions, understand the downstream effects of your decisions, and build a much more resilient growth plan.

To get a better handle on how this technology works in practice, check out our ultimate guide to using generative AI for B2B marketing and sales growth. By embracing AI, you're not just improving a process; you're fundamentally upgrading your ability to lead.

Best Practices For A Credible Forecast

A forecast is only as valuable as it is believable. Anyone can throw ambitious numbers on a slide, but creating projections your board, investors, and team actually trust requires discipline. It’s about grounding your ambition in reality.

Think of it this way: a forecast built on pure optimism is like a bridge made of hopes and dreams—it’s bound to collapse under the slightest pressure. A credible forecast, however, is a bridge built with steel and concrete, engineered to withstand scrutiny and guide you safely to the other side.

Build Multiple Scenarios

Never present a single, perfect projection. The future is uncertain, and showing that you’ve thought through the possibilities demonstrates strategic maturity. The professionals always build out three distinct scenarios.

- Best-Case: This is your optimistic but still plausible outcome. What happens if those key deals close early and your new marketing campaign wildly overperforms?

- Base-Case: This is your most realistic forecast, grounded firmly in historical data and your current pipeline velocity. It's the number you're committing to.

- Worst-Case: Your conservative projection. What's the plan if economic headwinds pick up or a major renewal churns unexpectedly?

This approach proves you’re prepared for both opportunity and adversity. That preparation alone builds immense confidence with anyone looking at your numbers.

Ground Assumptions in Historical Data

Every single number in your forecast needs a story backed by data. Ambition is critical for a startup, but it can’t be the primary driver of your projections. If you’re forecasting a 30% jump in new MRR, you must be able to point to the specific inputs that will make it happen.

Don’t just say, "We’ll grow faster next quarter."

Instead, explain it: "Our pipeline has grown 40%, our lead-to-close conversion rate improved by 5% last month, and we’re launching a new pricing tier. These factors all support our projected 30% growth." This requires a deep understanding of your key drivers; you can learn more about which SaaS marketing metrics are most important in our detailed guide.

A credible forecast is an argument, not an announcement. Every number must be defended with evidence, connecting your past performance to your future expectations.

Collaborate With Key Leaders

Revenue forecasting should never happen in a finance silo. Your projections are directly tied to the real-world execution capabilities of your sales and marketing teams. Without their input and buy-in, your forecast is just a fantasy.

Schedule regular meetings with your sales and marketing leaders. Go through the pipeline together, discuss campaign performance, and align on every assumption. This collaborative process ensures the people responsible for hitting the numbers actually believe they are achievable. It creates shared ownership over the outcome, which is exactly what you want.

Treat Your Forecast as a Living Document

Finally, remember that a forecast is not a "set it and forget it" document. The market changes. Deals slip. New opportunities appear out of nowhere. Your forecast has to adapt.

Establish a regular cadence—monthly is perfect for early-stage companies, quarterly for more mature ones—to review your actual performance against your forecast. Analyze the variances, understand why they happened, and then adjust your future projections based on these new insights.

This iterative process makes your forecast more accurate over time and, more importantly, keeps it relevant as a day-to-day decision-making tool.

Building Your First B2B Revenue Forecast

All the models and theories in the world are great, but nothing really clicks until you see it in action. So, let’s walk through how a fictional B2B founder, Sarah from ‘SaaSCo,’ would build her very first 12-month revenue forecast.

Think of this as a tangible story you can follow, turning abstract concepts into a clear, actionable path.

Sarah’s first move? Grounding the forecast in reality, not wishful thinking. She pulls the last six months of her Monthly Recurring Revenue (MRR) data straight from her payment processor. This isn't about guesswork; it's about starting with the hard numbers you already have. Right away, she sees a clear, consistent growth trend.

From Data to Decisions

Next, she dives into her sales pipeline. Sarah opens up her CRM and starts analyzing the active deals. She notes the number of qualified leads, their average contract value ($15,000 ARR), and, most importantly, her historical win rate (25%).

This pipeline data gives her a forward-looking view, showing what’s realistically convertible into new revenue in the coming months. It’s the difference between hoping for growth and seeing where it’s actually coming from.

Now, she combines these two data points to establish a data-backed growth rate. Instead of just picking an ambitious number out of thin air, she sees her past MRR growth and current pipeline can support a 10% month-over-month growth projection. This is the base-case scenario, and it's a crucial step for anyone learning how to forecast demand effectively.

A forecast is a story you tell with numbers. For SaaSCo, the story is about translating past momentum and a healthy pipeline into a credible projection of future growth.

With the projection complete, the forecast transforms into Sarah’s strategic guide. She can now clearly see that if her projections hold, she has the financial runway to hire that much-needed engineer in Q3.

But the model also flashes a warning sign. It reveals a potential cash crunch by Q4 if a few of those larger deals slip. This single insight turns the forecast from a simple spreadsheet into a critical decision-making tool. It tells her she needs to start conversations for a seed round by the end of the year to fuel the next stage of growth.

Common Questions About Revenue Forecasting

Even with the best models in place, you're going to have questions as you learn revenue forecasting. That's perfectly normal. Getting those questions answered is what turns the theory into real-world confidence. Let's walk through some of the most common things B2B founders ask when they start building out their financial roadmap.

How Often Should I Update My Forecast?

For any early-stage B2B company, you should be reviewing your forecast monthly. The business environment is moving too fast to do it any less frequently. A monthly check-in lets you react quickly to new information, whether that’s a churn rate that’s increasing or a huge deal that just closed ahead of schedule.

Once your business matures and operations become more predictable, you can comfortably shift to a quarterly review. The main idea is to treat your forecast as a living document—not some static plan you create once and then set in stone.

A forecast is a tool for navigation, not a prophecy. Regular updates ensure you are always steering with the most current map available, helping you understand not just what revenue forecasting is but how to apply it on the fly.

What Are The Biggest Forecasting Mistakes I Can Make?

By far, the most common trap B2B founders fall into is being overly optimistic. They build projections based on pure ambition instead of grounding them in historical data. This creates a plan that's completely disconnected from reality, and it's a fast way to erode trust with your team and investors.

A few other critical errors we see B2B companies make include:

- Ignoring customer churn: It's easy to get excited about new revenue, but you must account for customers that will inevitably leave.

- Misjudging sales cycle length: This is a classic. Founders often assume deals will close much faster than they actually do in the B2B world.

- Forecasting in a silo: You can't just create numbers in a back room. A forecast is useless without input and buy-in from your sales and marketing leaders.

At the end of the day, a credible forecast is always built on a realistic, clear-eyed view of the business.

What Tools Can I Use Besides Spreadsheets?

Spreadsheets are a fantastic place to start, and honestly, they're all you need for a while. But as you scale, you'll want something with a bit more power. Most CRMs, like HubSpot and Salesforce, have built-in forecasting features that tie directly into your sales pipeline.

When you're ready for more advanced insights, you can look at dedicated revenue intelligence platforms. Tools like Clari or Gong use AI to analyze every single customer interaction, giving you much sharper predictions. For deep financial planning, tools like Jirav or Cube offer powerful forecasting features designed specifically for growing companies.

At Big Moves Marketing, we help B2B SaaS founders build the strategic foundation for growth, from go-to-market planning to creating the sales tools that help you hit your forecast. Discover how we can help you bring your product to market and drive revenue.

%20png%20copy.png)

%20-%20white.svg)