The B2B Appointment Setting Playbook For Founders Who Hate Wasting Money

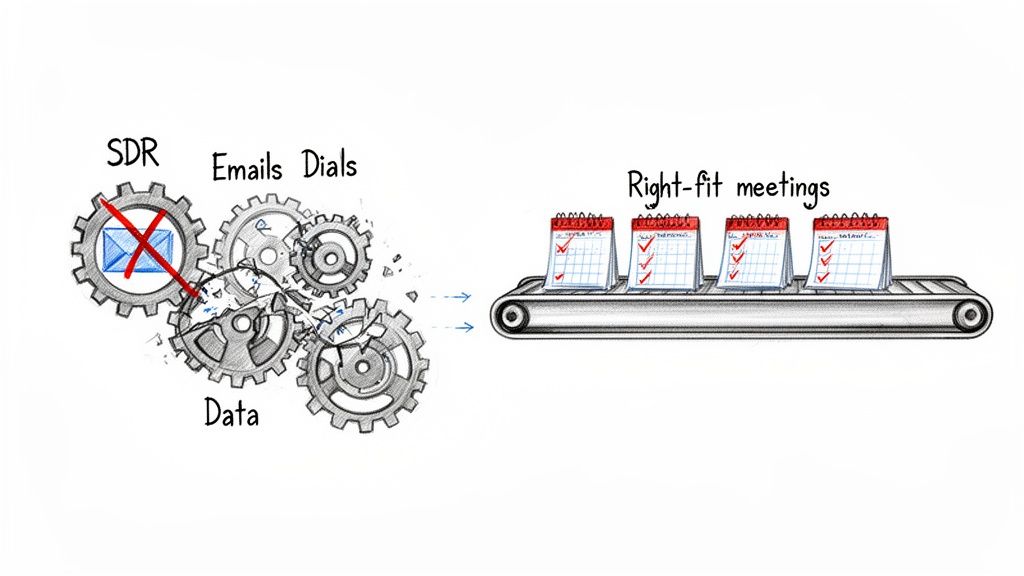

Most B2B appointment setting functions don’t fail from a lack of effort. They fail because they’re built on a flawed premise.

SaaS founders have been sold a dangerous myth: that pipeline is a direct function of activity volume. More dials, more emails, more SDRs. But the goal isn't to book more meetings. It's to source the right meetings, and to do it with ruthless capital efficiency. Chasing volume is just an expensive way to mask a broken go-to-market strategy.

Your Appointment Setting Engine Is Broken, Not Inefficient

The noise from a sales development team—the flurry of dials, the endless email sends—often just masks a deep, strategic failure. When leaders see low conversion rates, their first instinct is to throw more resources at the problem: more budget, more headcount, more tools. It’s like trying to fix a sputtering engine by pouring more gasoline on it.

This approach treats symptoms while the disease ravages your go-to-market motion. Your appointment setting function isn't just inefficient; it's likely built on a broken model. It’s a machine designed to create motion, not results.

Misdiagnosing The Symptoms

The warning signs of a broken system are almost always misinterpreted as performance issues or a need for better tactical execution. In reality, they are the predictable outcomes of a flawed strategic design.

You're likely seeing these common misdiagnoses:

- High SDR Burnout: This isn't just a "tough job." You're asking good reps to execute a failing strategy with poor targeting and weak messaging. No amount of grit or caffeine can overcome a broken GTM motion.

- Poor Meeting Quality: The blame usually falls on "lazy qualification." The real culprit is a volume-based incentive structure that pays SDRs for booking any meeting, regardless of whether the prospect has a real problem or the authority to solve it.

- Clogged Sales Pipeline: This is often framed as a "good problem to have," but it’s a cancer. It’s the direct result of unqualified prospects consuming valuable AE time, destroying morale, and torpedoing your forecast accuracy.

These aren't isolated problems you can fix with a new script or a training session. They are systemic failures.

The core mistake is viewing B2B appointment setting as a cost center focused on activity instead of an economic engine focused on profit. Every dollar put into data, tools, and salaries must generate a predictable and profitable multiple in qualified pipeline value. Anything less is expensive theater.

Reframing The Problem

A successful appointment setting function isn't about brute force. It’s an exercise in economic precision. The real game is to identify and engage the smallest possible group of accounts that have the highest probability of closing, and to do it with maximum capital efficiency.

This requires a fundamental shift in thinking. Instead of asking, “How can we do more?” leaders must start asking, “How can we hit our pipeline target with the least possible motion?”

That single question forces better upstream decisions about your Ideal Customer Profile (ICP) and whether your messaging actually resonates. It's what separates sustainable growth from the high-burn, high-churn activity that plagues most sales floors.

The solution isn't to make your broken engine run faster; it's to redesign the engine entirely. For a comprehensive look at how to do this, a modern playbook for B2B appointment setting is a solid resource that emphasizes strategic alignment over tactical churn. The rest of this guide will provide the framework for that redesign, moving you from a volume-obsessed function to a precision-driven pipeline machine.

Your Ideal Customer Profile is Tragically Insufficient

Most founders think they have a solid Ideal Customer Profile. It’s usually a slide in a pitch deck listing basic firmographics: company size, industry, geography.

For building a serious B2B appointment setting engine, that’s catastrophically inadequate. It’s like trying to navigate a city with a map that only shows country borders.

This surface-level approach is why most outbound campaigns fail. It tells your team who might be in the market but gives them zero insight into why they would take a meeting, let alone buy. The result? Your SDRs burn through lists, chasing accounts that look perfect on paper but have no real pain, no budget, and no intent to act.

A scalable outbound machine isn't built on firmographics. It's built on a multi-layered understanding of triggers, pain signals, and buying intent. This is how you shift from casting a wide, inefficient net to throwing a sharp, effective spear.

Moving Beyond Firmographics

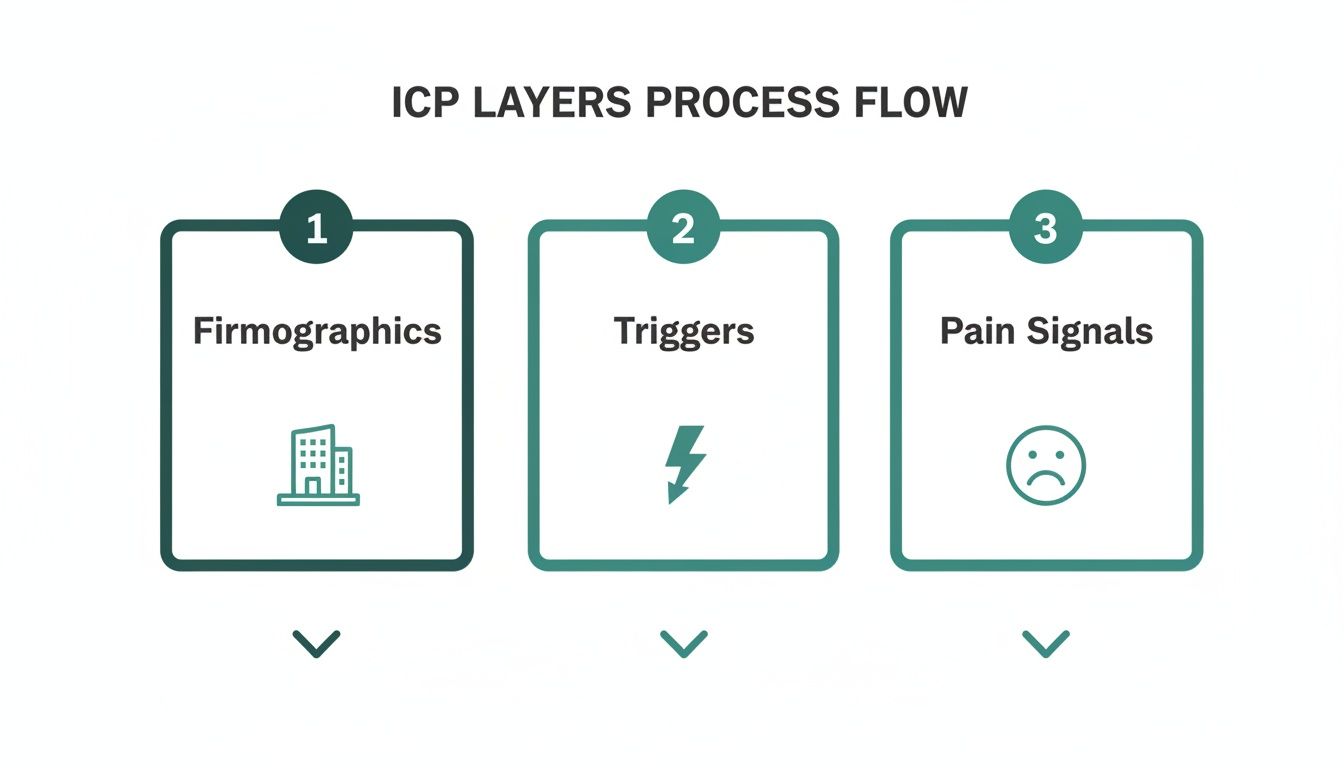

To build a predictable pipeline, you must get past the "who" and dig into the "why now." A functional ICP for appointment setting needs three distinct layers, each sharpening your targeting and increasing your probability of a real conversation.

- Firmographics: The foundation—industry, employee count, revenue. A necessary starting point to size your market, but it provides the weakest signal of buying intent.

- Technographics & Operational Triggers: This layer answers: "What signals suggest they're feeling the pain we solve?" This is where the intelligence kicks in. Are they hiring for a specific role? Did they just close a new funding round? Are they using a competitor's tech that you replace?

- Psychographics & Pain Signals: The highest-value layer. It answers, "Where are they openly talking about their problems?" This could be a key executive complaining on LinkedIn about a problem your product solves, a company leaving a negative review for a competitor on G2, or someone asking questions in an industry forum that tie directly to your solution.

Targeting a company based on firmographics alone—with zero triggers or pain signals—is a guaranteed waste of time and money. Your outreach will be irrelevant to their current priorities.

The goal isn’t to find every company that could buy your product. It’s to find the tiny subset of companies that must solve the problem you address in the next two quarters. The difference is everything.

Building A Tiered and Actionable ICP

Once you have these layers defined, you can stop treating your entire target market as a uniform blob. A tiered approach focuses your most expensive resource—your SDRs' time—where it will have the biggest impact.

Here’s how to put it into practice:

- Tier 1 (The Bullseye): These accounts match all three layers. They fit firmographics, show multiple tech or operational triggers, and have visible pain signals. 80% of your outbound effort should be laser-focused here. The messaging can be incredibly specific and direct.

- Tier 2 (High Potential): These accounts fit firmographics and show clear trigger events, but the pain isn't public. They should get about 15% of your focus. Outreach here is less about solving a known problem and more about educating them on an issue they might not have prioritized.

- Tier 3 (Opportunistic): These accounts only match your firmographics. They receive just 5% of your effort, typically through lower-touch, automated sequences designed to nurture and monitor for future trigger events.

This tiered model forces strategic discipline. It stops your team from burning out chasing low-probability targets and concentrates their energy on accounts ready for a conversation. In today's market, that kind of focus is non-negotiable.

With contact rates for even top-performing teams dipping to around 12-18%, every outreach attempt has to count. To dig deeper into how these numbers are shaping go-to-market plays, check out this 2025 industry report from Leads at Scale.

Ultimately, a sophisticated ICP isn't just a document; it's a dynamic targeting system that guides your entire go-to-market strategy. To get started building your own, review our guide on creating a powerful ideal customer profile template. It’s the first step in transforming your appointment setting from a game of chance into a predictable engine for revenue.

Designing Sequences That Compel A Response

If your outreach strategy includes the phrase "just checking in," you have already lost. Most multi-touch sequences feel like automated nagging because that's what they are. Effective outreach isn't about brute-force persistence; it’s about orchestrating a series of strategic, value-based touches that build a case with every step.

Crafting a high-performing sequence is less about a checklist of "email, call, connect" and more about psychological architecture. You must shift from self-centered messaging ("We do X") to prospect-centric messaging ("I see you're facing Y; leaders at Z solve it this way"). Anything less is noise.

This process starts by layering your Ideal Customer Profile (ICP) for maximum impact, moving from broad firmographics down to specific, timely pain signals.

This structured approach ensures your outreach is aimed at prospects who not only fit your target market but are also showing clear signs that they need your solution now.

Architecting The Cadence And Channel Mix

The common playbook is broken. Sending three emails, making two calls, and adding someone on LinkedIn over 14 days is arbitrary. The right cadence depends entirely on the persona you're targeting.

Engineers live in their email but often ignore LinkedIn. Sales leaders? The opposite. A founder might only respond to a single, hyper-personalized message that delivers immediate, high-level value.

Your channel selection must be a conscious choice based on where your ICP actually spends their attention.

- Email: The workhorse for detailed, insight-driven messages. Use it to introduce a problem, share a non-obvious observation, or provide a useful resource. It’s where you articulate your core value proposition.

- LinkedIn: Perfect for building social proof and credibility. Reference a mutual connection, comment thoughtfully on their content, or share a relevant case study. It's about building familiarity before you ask.

- Phone: Reserved for high-value, surgical touchpoints. A cold call's goal isn't to pitch; it's to spark curiosity and secure a follow-up. A well-placed voicemail can cut through the digital noise.

The fatal flaw in most B2B appointment setting is treating all channels as interchangeable broadcast mediums. They are not. Each channel serves a distinct psychological purpose in moving a prospect from unaware to interested. Misusing them erodes trust and guarantees you'll be ignored.

Benchmarks for 2025 show that B2B cold calling success rates hover at a meager 2.3-2.5%. That translates to one meeting for every 40-45 dials. However, elite teams hit 5-8% or higher by integrating intent data and smarter orchestration. A multi-touch strategy combining phone, LinkedIn, and email is now the standard for lifting response rates. You can explore the full findings on B2B sales for 2025 to dive deeper.

To make this concrete, here's an example of a thoughtful, multi-channel sequence for a Tier 1 prospect.

Sample 21-Day Multi-Channel Outreach Cadence

This isn't a rigid template but a framework for thinking. The goal is to build a narrative over time, not just blast messages.

Messaging That Earns The Conversation

Generic, feature-focused messaging is the fastest way to get your emails deleted. Your outreach must earn the prospect's time by being immediately relevant to their world. Stop talking about your product and start talking about their problems.

Here are the core message types that actually work:

- The Problem-Agitate-Solve Email: Your opening move. Start by identifying a specific, painful problem relevant to their role and industry. Agitate that problem by highlighting the negative consequences of inaction. Then, briefly position your solution as the path to resolution.

- The Insight-Driven LinkedIn Message: This touchpoint should deliver value without an ask. Find a post they shared or an article their company published and add a sharp, non-obvious insight. Example: "Saw your post on scaling engineering teams. A pattern we've seen with Series B companies is that hiring velocity often breaks the onboarding process. Is that on your radar?"

- The Reference Point Voicemail: Never pitch in a voicemail. Your only goal is to create a hook that drives them to your email or LinkedIn profile. Keep it under 30 seconds. Example: "Hi [Name], it's Alex from Big Moves. I sent you an email with the subject 'ICP Observation.' It's about a pattern I noticed with companies in the [Industry] space. Talk soon."

This prospect-centric approach is everything. If you're struggling to apply these principles, our guide to effective B2B email marketing provides a deeper dive into crafting messages that resonate.

Designing sequences that work is less about finding the perfect template and more about developing a genuine, obsessive understanding of your buyer's context. Your outreach should feel less like a sales pitch and more like the beginning of a valuable, consultative conversation.

The In-House Versus Outsourced Decision Framework

When founders consider their B2B appointment setting function, they almost always frame it as a simple cost question: build in-house or outsource?

This is a strategic mistake. The choice isn't just a line item on a budget; it's a fundamental go-to-market decision that hinges on your company’s maturity, the complexity of your market, and—most importantly—your internal leadership capacity.

Treating this like a simple cost-benefit analysis leads to predictable, painful failures. You either end up with an under-resourced internal team burning cash and morale, or you partner with a misaligned external firm that damages your brand's reputation. The right answer depends entirely on where you are right now.

The True Cost of an In-House SDR Team

Most leaders dramatically underestimate the fully-loaded cost of a single in-house Sales Development Representative. It’s not just their salary. The real number is a blend of direct and indirect expenses that often doubles the sticker price.

Here’s what you’re actually investing in:

- Compensation: The base salary, commission, and benefits.

- Tools & Data: CRM seats, sales engagement software (e.g., Outreach, Salesloft), data providers (e.g., ZoomInfo), and dialers. This adds up fast.

- Recruiting & Onboarding: The cost to hire and the productivity lost during ramp-up. It typically takes a new SDR 3-6 months to become fully productive. That's a quarter or two of burning cash before you see results.

- Management Overhead: A junior SDR team needs significant, hands-on management from a sales leader. That leader's time is your most expensive asset.

This is the hidden tax of building in-house. You’re not just hiring a rep; you’re building an entire function, which drains focus and capital that could be used to build a better product or close deals.

When to Build In-House

Despite the high cost and management drag, building an in-house team is the right strategic move in a few specific scenarios. You should build, not buy, when your sales motion requires deep, nuanced expertise that is too difficult to transfer to an outsider.

Consider building your own team if:

- Your Product is Highly Complex: If selling your solution requires deep technical knowledge or a consultative discovery process, an in-house team is non-negotiable. They need to live and breathe your product.

- Your ICP is Nascent or Evolving: When you're still figuring out your Ideal Customer Profile, the rapid, unfiltered feedback loop from an internal team is priceless. Their conversations are raw market intelligence critical for honing your positioning and messaging.

- You Have Proven Sales Leadership: This is the most critical factor. You need an experienced Head of Sales or VP who has built and scaled an SDR function before. Without this leadership, you are setting a junior team up for failure.

When to Partner with an External Firm

Outsourcing B2B appointment setting isn't about saving money; it's about buying speed, expertise, and predictability. A specialized partner gives you immediate access to a proven process, trained talent, and a robust tech stack—without the massive upfront investment and painful ramp time.

Think about partnering with an external firm if:

- You Need to Test a New Market: When entering a new vertical or geography, an outsourced partner lets you validate the market quickly and affordably. It's a low-risk way to get data before you commit to full-time hires.

- You Lack Internal Sales Leadership: If your founding team is product-strong but lacks go-to-market sales experience, a good partner can provide the strategic oversight and execution framework you need to generate pipeline.

- You Need to Scale Predictably: A mature partner can add qualified meetings to your pipeline at a predictable cost-per-appointment. This allows you to dial your sales efforts up or down in response to market demand, giving you flexibility.

This decision is fundamentally about resource allocation. Are you buying a capability you currently lack, or are you building a core asset that will become a long-term competitive advantage? The answer to that question determines your path.

Recent data shows the cost per qualified appointment from a firm can range from $350 to $1,700, and companies that outsource often see 40-60% faster pipeline growth in the early stages. For a SaaS business with a $20k ACV, a single closed deal can cover the cost of ten qualified meetings, delivering a clear ROI in one quarter.

Choosing between an in-house SDR team and an outsourced partner isn't just about finding people to make calls. It's a strategic decision that will shape your go-to-market motion. As you weigh your options, exploring various appointment setting companies can give you a better sense of the landscape. And if you're thinking about how an external partner fits into your wider growth strategy, our guide on choosing the right agency for B2B marketing may offer valuable perspective.

Measure Pipeline Velocity, Not Vanity Metrics

Your SDR dashboard is probably a graveyard of good intentions. It’s littered with activity metrics—dials per day, emails sent, connection rates—that make leaders feel productive but reveal nothing about economic impact.

A high-performing B2B appointment setting function isn't a call center; it's an economic engine. Its success must be measured by its contribution to revenue, not by how busy it looks.

Chasing activity is a strategic dead end. It incentivizes the wrong behaviors, rewarding reps for volume over value. This leads directly to low-quality meetings that waste AE time, a pipeline clogged with unqualified leads, and a demoralized sales team.

The conversation must shift from "Are my reps busy?" to "Is this function generating profitable growth?" To do that, you must abandon vanity metrics and embrace a model that measures the speed at which qualified pipeline turns into revenue. You must measure pipeline velocity.

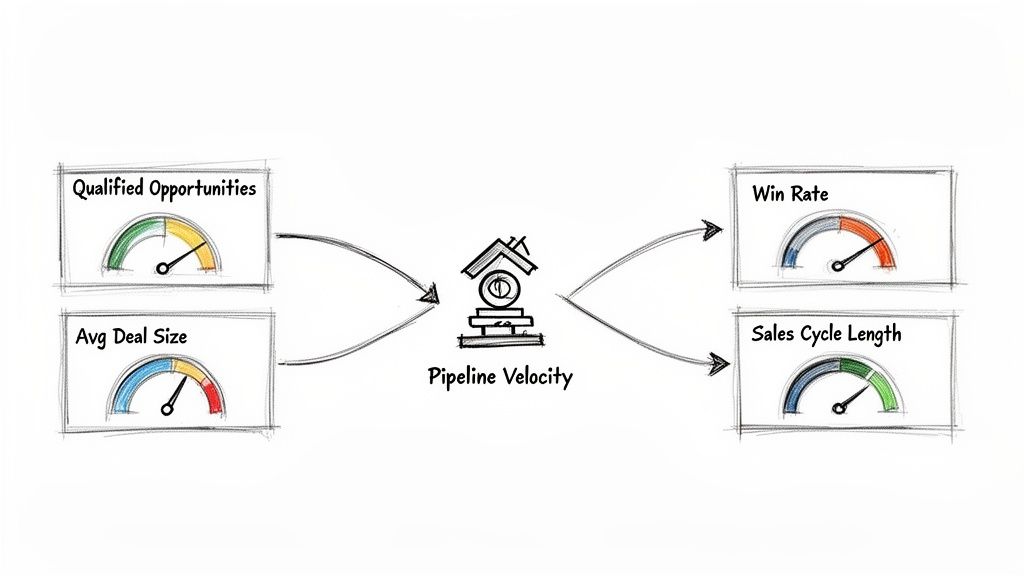

The Four Pillars of Pipeline Velocity

Pipeline velocity is a simple, unflinching formula that tells you exactly how much revenue your pipeline is generating per day. It connects your appointment setting efforts directly to financial outcomes, forcing a level of accountability that activity tracking makes impossible.

The formula hinges on four core metrics. No more, no less.

- Number of Qualified Opportunities: The total count of sales-accepted opportunities (SAOs) generated by the SDR team in a given period. Not meetings booked; meetings that pass a strict, mutually agreed-upon qualification standard.

- Average Deal Size ($): The average contract value of all closed-won deals that originated from those SDR-sourced opportunities. This ensures your team is hunting for accounts with real economic potential.

- Win Rate (%): The percentage of qualified opportunities that convert into closed-won customers. A low win rate here is a direct signal of poor upstream qualification by the SDR team.

- Sales Cycle Length (Days): The average number of days it takes for a qualified opportunity to move from creation to a signed contract.

These four inputs are the only numbers that matter. They are the diagnostic tools for your entire go-to-market motion.

Calculating and Applying the Formula

The calculation itself is straightforward:

(Number of Qualified Opportunities x Average Deal Size x Win Rate) / Sales Cycle Length

The result is your Pipeline Velocity—the dollar amount of revenue your pipeline generates each day. This single metric becomes your north star. When you optimize for velocity, you are forced to make smarter decisions about everything that comes before it.

A low number of opportunities forces you to refine your ICP and messaging. A small deal size means you're targeting the wrong market segment. A poor win rate exposes weak qualification criteria. A long sales cycle reveals friction in your sales process. Velocity doesn't just measure; it diagnoses.

This shift requires a complete overhaul of how you manage your SDR function. It’s about moving the team from a cost center obsessed with activity to a strategic asset focused on creating high-quality, high-velocity pipeline.

For a deeper look into connecting inputs to outcomes, you might be interested in our guide on how to measure marketing effectiveness.

The table below starkly contrasts the old way of thinking with the new. It's about moving from tracking effort to tracking impact.

Adopting this model isn't just about changing a few KPIs on a dashboard. It’s about changing your philosophy on what B2B appointment setting is for.

It stops being about filling calendars and starts being about building a predictable revenue machine.

Answering Founder Questions On Appointment Setting

Theory is cheap. Execution is everything. When building a scalable B2B appointment setting function, founders and revenue leaders get stuck on the same handful of critical questions. I’ve seen it across dozens of growth-stage SaaS companies.

Here are the direct, unfiltered answers.

What Is a Realistic Number Of Appointments Per SDR Per Month?

This is the wrong question. It optimizes for activity, not impact. The question you should be asking is, "What is the value of qualified pipeline my SDRs can generate?"

A top-tier SDR in a B2B SaaS company should be sourcing 8-12 Sales-Accepted Opportunities (SAOs) per month.

Notice I didn't say "meetings booked." An SAO isn't a calendar invite; it's a conversation that meets strict, pre-defined qualification criteria that your Account Executives have bought into. It’s a meeting they want to take.

Anything less than that number signals a fundamental problem upstream. The issue is almost never the SDR. It's a breakdown in your ICP definition, your messaging, or the quality of your list. Chasing raw meeting numbers inevitably leads to a pipeline full of unqualified leads that burn AE time, destroy morale, and tank your win rates.

The goal is pipeline contribution, not a busy calendar.

How Long Until We See ROI From This Program?

Think in stages. You won't be closing deals on day 30.

Within the first 30-45 days, you should see leading indicators—positive reply rates and initial meetings held. This is your first signal that the messaging is resonating at a surface level.

Within 60-90 days, you should see qualified opportunities (SAOs) populating the pipeline. This is the first true sign of program health.

A tangible ROI, measured by closed-won revenue, depends on your average sales cycle length. If you have a 90-day sales cycle, you should expect to see a positive return on investment within six months.

If you are not seeing qualified opportunities hit your pipeline by day 90, your strategy is broken. Do not wait. Halt the program and diagnose the failure point. I guarantee it's one of three things: your targeting, your messaging, or your offer.

What Is The Single Biggest Mistake Founders Make Here?

The single most destructive mistake is a lack of strategic alignment between marketing, sales development, and sales. Most companies operate these functions as disconnected silos, which kills any chance of building a scalable engine.

This misalignment creates a predictable pattern of failure:

- Marketing generates broad leads based on top-of-funnel content, with little regard for sales-readiness.

- SDRs book meetings with anyone willing to take one, driven by volume-based quotas that ignore lead quality.

- AEs get frustrated with low-quality conversations that go nowhere, leading to missed forecasts and high team churn.

A successful program is built on a tightly defined, shared understanding of what constitutes a Sales Qualified Lead (SQL) and, more importantly, a Sales-Accepted Opportunity (SAO). The handoff between each stage must be bulletproof, governed by clear, objective criteria that everyone has agreed on.

Without this deep, cross-functional alignment, you are not building an engine. You are creating organizational friction and burning cash with incredible efficiency. True scalability comes from this shared clarity, turning disparate activities into a cohesive, high-performance go-to-market motion.

At Big Moves Marketing, we help B2B SaaS founders move beyond tactical churn and build the strategic GTM foundation that drives predictable revenue. If you need clarity on your positioning, messaging, and sales enablement to make your appointment setting efforts profitable, let's connect: https://www.bigmoves.marketing.

%20-%20Alternate.svg)

%20-%20white.svg)