What Is Market Positioning Strategy for B2B SaaS Founders

January 23, 2026

Most B2B SaaS teams get this wrong: a market positioning strategy isn't about the words you use on your website. It's about the hard strategic decisions that dictate who you win, who you ignore, and why you have the right to exist in a crowded market.

It is the silent architecture behind your entire go-to-market motion, built from deliberate choices about which slice of the market you can dominate—long before a single word of copy gets written.

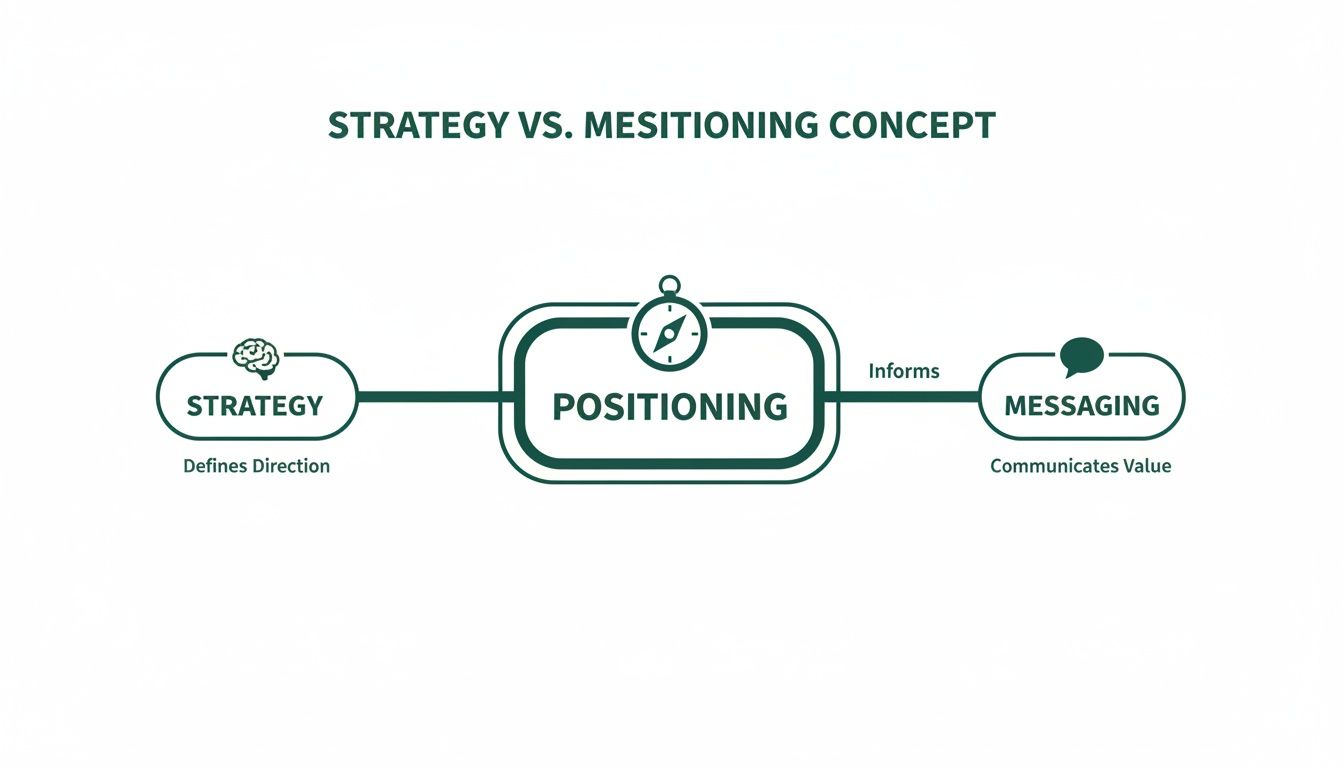

Positioning Is Strategy, Not Messaging

The most expensive mistake a B2B SaaS founder can make is confusing positioning with messaging. They are not the same. Treating them as interchangeable is the root cause of stalled growth, confused sales teams, and marketing budgets that evaporate with zero impact.

Messaging is a tactical output. It's the copy on your website, the script for a sales call, the content for a demand gen campaign.

Positioning is the strategic input. It's the series of disciplined, often painful, choices you make about where to compete and how you will win.

The Foundation Precedes the Penthouse

Attempting to craft clever messaging on weak positioning is like designing a penthouse on a foundation of sand. It might look impressive for a moment, but it collapses under the slightest pressure from a competent competitor or a skeptical buyer.

Too many founders, desperate for pipeline, jump straight to wordsmithing taglines and feature lists. They obsess over what to say, skipping the brutal but necessary work of deciding where to stand.

This is how technically proficient products become commercially invisible. They show up in a crowded category, say the same things as everyone else, and then founders wonder why their sales cycles are endless and their win rates are abysmal.

A market positioning strategy isn't about finding perfect words. It’s about making the hard choices that make your words believable and your value undeniable. It is the source code for your go-to-market execution.

From Vague Concepts to Hard Choices

Real positioning is not a creative exercise; it is a strategic one. It forces you to answer uncomfortable questions that have real consequences for your product roadmap, your hiring plan, and where you allocate capital.

These are not marketing questions. They are fundamental business questions:

- Which specific segment of the market can we realistically dominate? Not just serve, but own.

- Who are we explicitly choosing not to sell to? If you are for everyone, you are for no one.

- What high-stakes problem do we solve better than any alternative? This includes direct competitors, clumsy internal workarounds, or doing nothing.

- What is our unique point of view on the market that makes our solution the only logical choice?

Without committed answers, any messaging you create is just guesswork. You can learn how these strategic decisions inform communication by exploring how to build a B2B messaging framework that works.

But the strategy must come first. Positioning is the deliberate act of choosing your battlefield. Only then can you craft the messages to win it.

The Core Components of a Defensible Market Position

Effective positioning is not some abstract concept conjured up in a marketing meeting. It’s a strategic framework—a series of interlocking components that every B2B SaaS leader must define with extreme prejudice. A defensible market position is built, not declared.

This isn’t about brainstorming taglines. It's about making hard choices that define your go-to-market reality. Below are the four pillars that separate market leaders from the forgotten, crowded middle.

Hyper-Specific Ideal Customer Profile (ICP)

Most teams define their ICP with lazy firmographics—company size, industry, geography. This is useless. It tells you nothing about who feels acute pain, who controls the budget, and who is actively searching for a solution like yours.

A strategic ICP goes deeper, focusing on the operational and political realities inside a target account:

- Operational Pain: What specific workflow is broken? Whose job is made difficult by this problem? What is the tangible cost of doing nothing, measured in wasted hours, missed revenue, or compliance risk?

- Political Landscape: Who champions this change? Who stands to lose influence if your solution is adopted? Understanding internal dynamics is often more critical than understanding the technical problem.

A sharp ICP isn't a broad target; it's a precise lock-on. It's not "mid-market tech companies." It's "Series B fintechs struggling with SOC 2 compliance using manual spreadsheets, led by a first-time Head of Security." The first is a marketing persona; the second is a revenue strategy.

The Uniquely Solved Problem

Once you know who you serve, you must define the one high-stakes problem you solve in a way no one else can. Your product likely has many features and solves several problems, but your positioning must be anchored to one.

This isn’t about having a "better" feature. It's about a fundamentally different approach that makes the old way obsolete. Your uniquely solved problem is the intersection of a critical customer need and your most defensible product advantage. Ask your team: if we disappeared tomorrow, what specific capability would our best customers be unable to replace? The answer is the seed of your positioning.

Positioning is the deliberate act of choosing the one hill you are willing to die on. A product that claims to solve ten problems effectively solves none in the mind of a skeptical buyer.

This is where most companies fail. They create a laundry list of benefits, hoping something sticks. This approach signals weakness and a lack of conviction. A strong position demands the discipline to focus on the single, most impactful outcome you deliver.

Many teams think they have positioning figured out, but they're really just playing with words. Here's how to spot the difference:

Superficial vs. Strategic Positioning Components

Strategic thinking means moving beyond "what" and digging into "why" and "how." It's about making tough choices that give your GTM teams a clear, defensible narrative.

This infographic shows how positioning acts as the strategic compass for both your core strategy and messaging execution.

Positioning isn't a marketing task; it's the central hub that translates strategic thinking into coherent communication.

Differentiated Value Proposition

Your value proposition is the clear, quantifiable answer to the buyer's single most important question: "Why should I choose you over my other options?" It must be articulated in the language of business outcomes, not product features.

A weak value prop says, "We have an AI-powered analytics dashboard." A strong one says, "We reduce customer churn by 15% in 90 days by identifying at-risk accounts your current tools can't see."

An effective value proposition must connect your uniquely solved problem directly to an economic or operational result. It must be:

- Specific: It names a clear outcome.

- Measurable: It implies quantifiable improvement.

- Defensible: It’s rooted in your unique capabilities.

To understand the nuances between positioning your product versus your brand, check out our guide on what is product positioning.

The Competitive Frame of Reference

You do not exist in a vacuum. Your prospects are constantly comparing you to alternatives. Your job is to deliberately choose the frame of reference that highlights your strengths.

Who are you really competing against in the buyer's mind?

- A Direct Competitor: "Unlike Salesforce, our CRM is built for fast-growing PLG companies and takes minutes to set up, not months."

- A Legacy System: "We replace the clumsy, error-prone spreadsheets your finance team uses for forecasting."

- The Status Quo: "Our platform automates the manual compliance work that currently takes two full-time employees to manage."

By choosing your "enemy," you define your category and make your unique value instantly understandable. You are not just another tool; you are the specific solution for a recognized problem, standing in stark contrast to an inferior alternative. This is how you control the narrative.

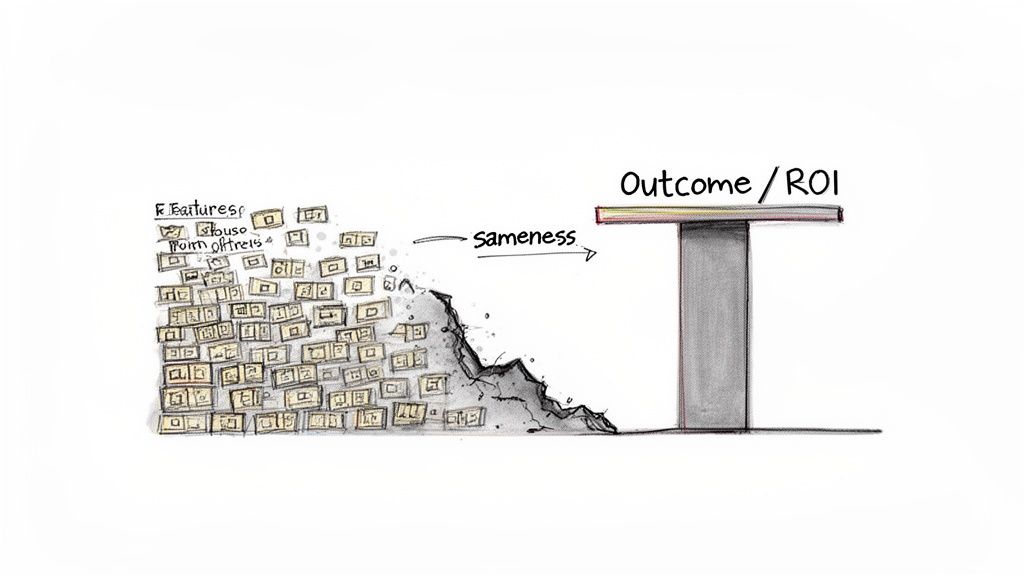

Why Better Features Is a Losing Strategy

For most product-led founders, this is the default setting: "We will win because we have better features." This belief is a strategic trap, and it’s the most common reason promising B2B SaaS companies stall. They get caught in an endless development cycle that never moves the revenue needle.

In today's B2B landscape, a meaningful feature advantage has a shelf life measured in months, not years. Your competitors—incumbents and upstarts—can and will replicate any function that gets traction. Competing on features is a race to the bottom, a direct path to commoditization and a bloated product that’s a nightmare to sell.

This entire strategy is built on the broken assumption that sophisticated B2B buyers make decisions by ticking off a feature checklist. They do not.

Buyers Purchase Outcomes, Not Code

A Head of Finance at a Series C company is not buying a "real-time analytics dashboard." She's buying the ability to walk into a board meeting and never again feel the panic of not being able to answer a direct question about cash flow.

A VP of Sales does not purchase a "CRM integration." He purchases the confidence that his team won’t lose a major deal because of a data entry mistake.

B2B buyers purchase three things, none of which is a feature:

- Outcomes: A measurable improvement to a core business metric.

- Risk Reduction: Assurance that a project will succeed and their professional reputation will be enhanced, not damaged.

- Strategic Advantage: A new capability their competitors lack.

A market positioning strategy built on features ignores this reality. It forces your sales team to talk about what the product is instead of what the product does for the customer's business. In any competitive deal, this is a fatal error.

The moment your salesperson is dragged into a line-by-line feature comparison, you have lost control of the sale. You have allowed the conversation to become a commodity bake-off where the only differentiator left is price.

The Feature-First Failure Scenario

Imagine this common situation. A founder-led sales team is pitching their compliance automation tool. They spend 30 minutes demoing a slick UI and a dozen impressive features.

The prospect, a Chief Compliance Officer, seems engaged. But at the end of the call, she asks the killer question: "This looks interesting, but how is this fundamentally different from the custom scripts our dev team built last year?"

The founder immediately falls back on feature-speak, talking about the UI's elegance and the reports' speed. The prospect nods politely and says she'll "circle back with the team." The deal goes dark.

The problem wasn't the product; it was the positioning. The founder positioned their tool as a better set of features, not as a strategic alternative to the risk and expense of internal builds. A stronger position would have preempted that objection by focusing the conversation on the total cost of ownership and the opportunity cost of distracting their engineering team.

Your market positioning strategy must be built on a dimension of value that is harder to copy than code. This is where you build a moat.

Your advantage must come from a source your competitors can't just throw developers at:

- A Proprietary Dataset: Do you have access to unique data that provides insights no one else can?

- A Unique GTM Motion: Can your community-led growth model be replicated by an old-school, enterprise sales-led competitor?

- A Fundamentally Different Business Model: Does your usage-based pricing make incumbents' rigid annual contracts look archaic?

Stop selling features. Start selling a fundamentally different—and better—way of achieving a critical business outcome. That is the only strategy that wins.

How to Build Your Positioning from First Principles

Most positioning exercises are a waste of time. They become endless wordsmithing sessions where the leadership team shuffles adjectives on a slide, ending with a generic statement nobody believes.

Real market positioning is not found in a template. It's forged by asking—and brutally answering—a few hard, first-principles questions.

This is not a fill-in-the-blanks worksheet. It's a thought process. Get your leadership team in a room and don’t leave until you have unflinchingly honest answers.

Who Are You Explicitly Choosing Not to Serve?

This is the most important question, and it's the one most founders avoid. The instinct is to keep options open, to build a product that could theoretically help a massive range of customers. That is a fatal mistake. A lack of focus does not create a bigger market; it creates a confused one.

Your anti-Ideal Customer Profile (ICP) is as important as your ICP. Defining who you are not for is an act of strategic clarity. It sharpens your product roadmap, concentrates your marketing spend, and gives your sales team permission to disqualify bad-fit leads in minutes.

- Are you building for enterprises with byzantine procurement cycles, or for nimble mid-market teams that need to ship yesterday?

- Is your product for technical users who live in APIs, or for business users who demand a no-code UI?

You cannot be for both. Trying to be everything to everyone guarantees you will be the first choice for no one. Great positioning is born from exclusion.

What Irreversible Market Trend Are You Riding?

Your product cannot create a market from thin air. The most dominant positioning strategies hitch their wagon to an undeniable, unstoppable trend that’s already reshaping your customers' world. Your product simply becomes the inevitable tool for navigating this new reality.

Are companies moving from on-premise servers to the cloud? Is the explosion of remote work forcing a total rethink of security protocols? Has a new regulation like GDPR created a sudden, non-negotiable business need?

Positioning your company as a response to a massive, external force is far more powerful than positioning it as just a better tool. You're not selling a feature; you're selling adaptation to an inevitable future.

Frame your solution not as an incremental improvement, but as the only logical next step in a story the market is already living. This shifts the conversation from "Why should I buy this?" to "How soon can we start?"

What Is the True Enemy You Are Positioning Against?

Every great story needs a villain. In positioning, your "enemy" is the alternative you're here to replace. It is almost never your direct competitor. Positioning against a direct competitor is a trap that leads back to the feature-by-feature fight we already know is a losing game.

Your real enemy is usually one of these:

- Legacy Software: The clunky, outdated system everyone secretly hates but is too embedded to rip out.

- Manual Processes: The chaos of spreadsheets, endless email chains, and Slack channels that passes for a "solution."

- The Risk of Internal Builds: The colossal opportunity cost and execution risk of a company trying to DIY a solution.

- The Status Quo: The simple inertia of doing nothing at all.

When you define this enemy clearly, you give your prospect a recognizable villain to rally against. Your product becomes the hero that slays the dragon. Our guide on a competitive analysis framework provides a toolkit for this.

How Do You Translate Technical Differentiation into Business Narrative?

Your engineers can talk for days about your elegant architecture or unique algorithm. Your economic buyer does not care. They care about three things: revenue, cost, and risk.

The final, critical step is to translate your technical "what" into a compelling business "so what?"

If your platform is built on a more scalable microservices architecture, the business story isn’t about the tech stack. It's about zero downtime during peak seasons, which means no lost revenue on Black Friday.

If you use a proprietary AI model, the story isn't about the model's parameters. It's about reducing manual data entry by 90%, freeing up employees to focus on higher-value work.

This translation is the core job of any go-to-market leader. It’s about building a bridge from your product’s features straight to the buyer's P&L. For practical frameworks, check out these 9 top brand positioning strategies that work for B2B growth.

Answering these four questions provides the strategic glue for your entire GTM team. It ensures product, marketing, and sales are all telling the same powerful, coherent story.

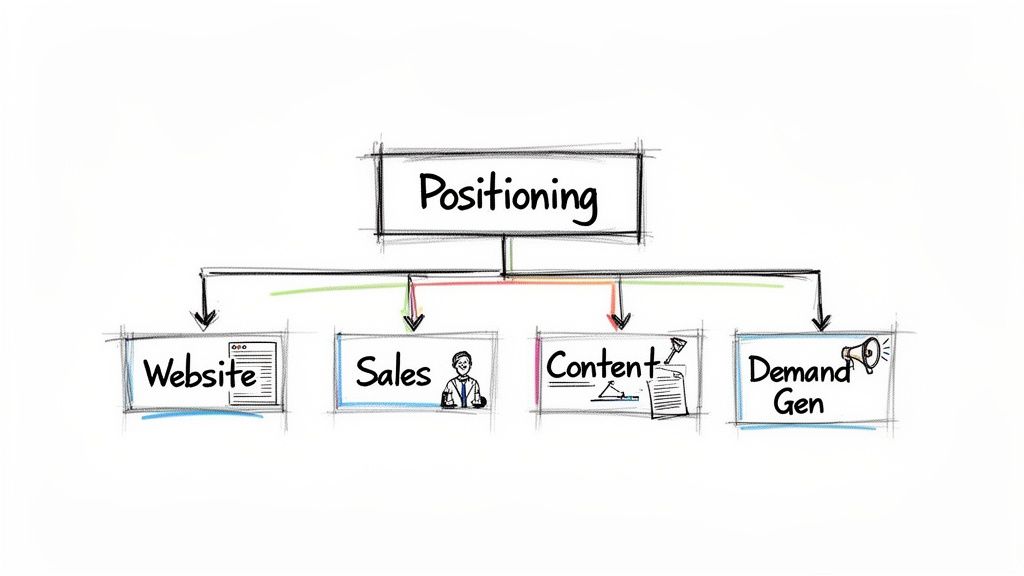

Activating Your Positioning Across the GTM Motion

A market positioning strategy confined to a slide deck is worthless. I’ve seen countless leadership teams complete a positioning exercise, feel good about the newfound clarity, and then change nothing about their day-to-day execution.

The strategy dies in the conference room.

Positioning only creates value when it’s activated—when it becomes the operational blueprint for every go-to-market (GTM) decision. A sharp position is not just a marketing concept; it’s a filter that simplifies choices and aligns the entire company on what to do and, more importantly, what not to do.

This is where theory meets revenue. A well-defined position dictates the architecture of your GTM motion with ruthless efficiency.

From Strategic Document to Tactical Reality

If your position is "the most secure compliance platform for enterprise finance teams," that single decision should cascade through every function. Your marketing team now has a clear mandate. Their job isn't to chase social media trends; it's to produce in-depth security whitepapers, detailed compliance guides, and case studies featuring CFOs from Fortune 500 companies.

Your demand generation stops wasting money on broad-reach channels. Instead, you get hyper-focused, running account-based marketing (ABM) campaigns against a precise list of enterprise finance leaders and sponsoring niche events where security and compliance are the main topics.

Your positioning strategy should make a hundred subsequent decisions for you. If every choice still feels like a debate, your positioning is too weak to be useful. That is a sign of strategic failure, not tactical indecision.

This alignment extends deep into your revenue organization. Your sales development representatives (SDRs) know which pain points to hammer in their outreach, and your Account Executives are equipped to speak the language of enterprise risk, not just product features.

Arming the Sales Team to Control the Narrative

In B2B SaaS, the sales conversation is the ultimate stress test for your positioning. A clear position is the foundation for every critical sales enablement asset you create.

This is how you translate strategy into tools that win deals:

- Pitch Decks: The narrative shifts from a product tour to a strategic argument. It starts with the market problem (crippling enterprise compliance risk) and frames your solution as the only logical choice for a specific buyer (the CFO).

- Competitive Battlecards: You’re no longer just comparing feature lists. Battlecards arm reps to reframe the conversation around your unique strengths, exposing a competitor’s weakness (e.g., "They're a generalist tool; we are purpose-built for enterprise-grade security protocols").

- Objection Handling Guides: Reps are prepared for pushback. When a prospect says, "Your price is higher," the answer isn’t a discount. It’s a confident explanation tied to your position: "Yes, because enterprise security requires an investment that cheaper, less secure platforms cannot make."

Aligning Investment with Market Intent

Activating your position also means aligning your budget with your ambition. A core principle here is the relationship between share of voice (SOV)—your slice of the promotional pie—and share of market (SOM). Research consistently shows that when a brand's SOV is greater than its SOM, market share reliably grows.

For B2B founders, this means prioritizing channels that reinforce your chosen position. According to HubSpot's 2023 marketing report, 88% of marketers focused on SEO plan to maintain or increase their investment, recognizing it as a top-tier channel for owning a category narrative and generating high-intent leads. To explore these trends, read the full report on marketing strategies.

When your positioning is clear, your entire GTM motion snaps into focus. You can learn more about aligning these elements by exploring our guide to building a B2B SaaS go-to-market strategy. Without this activation, you're just another company with a good idea, hoping someone notices.

Measuring the ROI of Your Positioning Strategy

Positioning is not a fuzzy branding exercise measured with vanity metrics. It's a strategic driver of pipeline and revenue. Its success is measured in hard commercial outcomes.

When your market positioning strategy works, you see a direct reduction of friction across your entire go-to-market motion. Your teams work less hard to achieve better results. This is not theoretical; it shows up in the numbers.

From Vague Impact to Leading Indicators

Most founders struggle to connect positioning to performance. They track lagging indicators like revenue, which are influenced by so many factors that it's nearly impossible to isolate the impact of strategy.

The key is to focus on leading indicators that prove your message is resonating in the market. These are the metrics that tell you if you're on the right track, long before the quarter closes:

- Sales Cycle Velocity: Are deals moving from discovery to close faster? A clear position preempts objections and confusion, shortening sales cycles because prospects "get it" quicker.

- Competitive Win Rates: When you go head-to-head against a key competitor, are you winning more often? Sharp positioning gives your sales team the narrative control to frame the deal on your terms.

- Average Contract Value (ACV): Are you able to command a price premium? Strong positioning moves the conversation from feature checklists toward strategic value, justifying a higher price.

The ultimate test of your positioning is when ideal prospects reflect your value proposition back to you in sales calls. When you hear your own language in their mouths, you have won the battle for their mind.

Listening for Resonance

Quantitative metrics are critical, but qualitative feedback is where you find the why. Some of the most valuable data is buried in sales call transcripts and discovery notes.

Are prospects describing their problem in the exact way you framed it? Are they using your terminology to articulate the value they’re looking for? This qualitative resonance is the earliest and purest signal that your strategy is landing.

In the competitive B2B landscape, this alignment is crucial. Today, up to 90% of the B2B buying process is complete before a salesperson is even engaged, making that initial resonance more critical than ever.

By focusing on these metrics, you can confidently measure the effectiveness of your marketing and confirm your positioning is a genuine business asset—not just a clever slogan.

Positioning Strategy Frequently Asked Questions

Positioning can feel abstract. Here are direct answers to common questions I hear from B2B SaaS founders.

How Often Should We Revisit Our Market Positioning Strategy?

Think of your positioning as a living document, not a stone tablet. The market moves, and your strategy must keep pace.

Pressure-test it quarterly. Plan a major review every 12-18 months. The exception is a significant market shift—a new competitor, a disruptive technology, or a change in how your customers buy. When that happens, you review it immediately.

Your GTM team is your early warning system. If they consistently hear that prospects are confused, or if competitive win rates dip, that's your cue to reassess. Don't wait for the revenue numbers to sound the alarm.

Can We Have Different Positioning for Different Segments?

No. You get one position. Period.

You can—and should—have tailored messaging for different segments. That messaging must flow directly from your single, core position. Your market positioning strategy is your company's singular, unified point of view on the market. Messaging is how you translate that point of view for the specific pains of different personas or industries.

Trying to be different things to different people is a recipe for mediocrity. It creates a weak brand, a confused GTM team, and a product roadmap pulled in a dozen different directions.

Our Product Does Many Things. How Do We Position Around One?

This is the heart of strategy: making deliberate, often painful, trade-offs. You must choose the one thing you want to be known for.

Your job is to pick the single capability that delivers the most significant value to your most valuable customer segment. It must also be the area where you have a durable, hard-to-copy advantage. In a buyer's mind, a product that "does everything" is a product that stands for nothing.

The goal isn't to list every feature; it's to own a specific problem. If you have more questions about the fundamentals, you might find answers in a dedicated article that defines What Is Market Positioning Strategy.

At Big Moves Marketing, we help B2B SaaS founders achieve this level of strategic clarity. We partner with you to define the positioning that gives you a true competitive edge and aligns your entire go-to-market motion. Find out how we can help you make your next big move.

%20-%20Alternate.svg)

%20-%20white.svg)