How to Identify Target Market for B2B Success

August 8, 2025

Identifying your target market is the most critical first step to getting any traction in B2B. This isn't about vague ideas; it's about defining the exact companies that desperately need your solution. You have to move beyond broad assumptions and build a data-driven Ideal Customer Profile (ICP) that will steer every single decision you make.

Move Beyond Guesswork to Find Your Ideal Market

The old "spray and pray" approach to B2B is dead. Casting a wide net and just hoping the right businesses swim into it is a recipe for burning cash and getting nowhere. Winning today demands a disciplined, almost surgical strategy to pinpoint your perfect customer.

It's a mindset shift—moving from hazy concepts about who might need your product to a crystal-clear, data-backed profile of the organizations that will not only use it but become your biggest fans.

This requires serious B2B customer research to uncover what’s really happening in your potential buyers' worlds. This isn't just a task for the marketing team; it’s a foundational business strategy. It influences your product roadmap, your sales tactics, and how you support your customers. When you know exactly who you're selling to, every part of your business becomes sharper and more effective.

The Power of a Data-Driven ICP

Think of your Ideal Customer Profile (ICP) as the north star for your entire company. It’s a living, breathing document that describes the perfect-fit company for your product—the one that gets the most out of your solution and, in turn, provides the most value back to you.

And I'm not just talking about basic firmographics like company size or industry. A modern, effective ICP goes much deeper:

- Firmographics: The essentials, like company revenue, employee count, and geographic locations.

- Technographics: The technology stack your ideal customers are already using. What software do they rely on?

- Behavioral Data: Actions that signal a need. Are they hiring for specific roles? Are they interacting with content about a particular problem?

The way we identify our ideal market has evolved. What used to be based on intuition is now driven by hard data and signals.

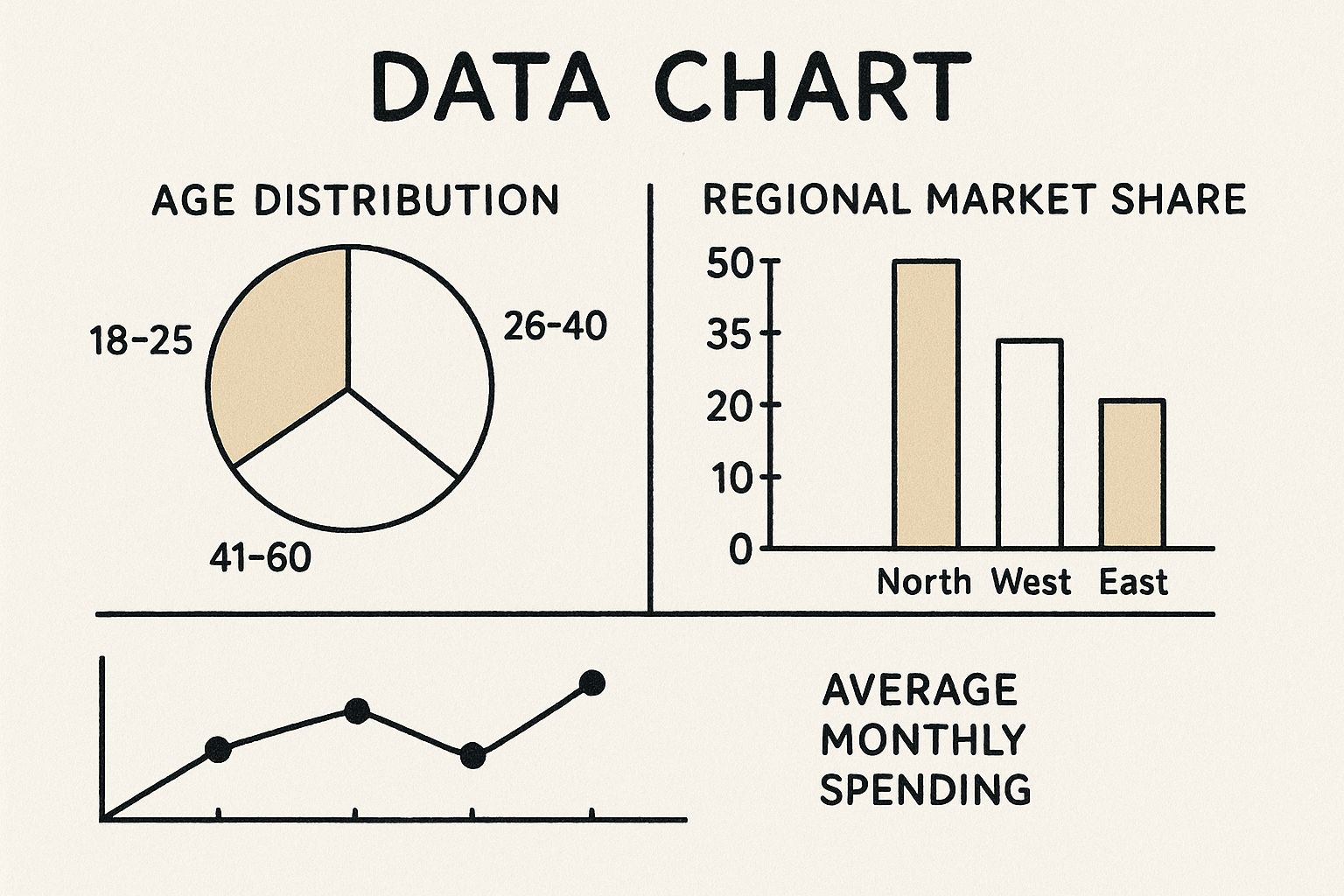

B2B Market Identification Old vs New Approach

This shift from guesswork to informed strategy is what separates the companies that struggle from the ones that scale sustainably.

This infographic breaks down some of the key data points—like age distribution of decision-makers, regional market share, and average spending habits—that should be feeding into your ICP.

When you visualize this kind of data, patterns jump out. You might spot a heavy concentration of ideal customers in one city or notice a specific spending capacity that signals a perfect fit, allowing you to focus your resources with incredible precision.

Embracing Modern, Informed Methods

The rise of AI is a massive catalyst for this data-driven approach. With the global AI market projected to hit an eye-watering $1.81 trillion by 2030, its ability to process vast amounts of real-time data is a game-changer for B2B marketers. We now have an unprecedented ability to analyze market signals and segment audiences with incredible accuracy. This isn't science fiction; it's happening right now.

Your goal is to find the businesses that are not only a great fit for your solution but are also ready and willing to invest in it. This clarity eliminates wasted resources and sets the stage for sustainable growth.

At the end of the day, your customers are just looking for straightforward solutions to their complex problems. As we've covered before, B2B buyers want simple choices. This just reinforces the need for a focused value proposition aimed at a well-defined, validated market.

Build Your Ideal Customer Profile with Precision

Your Ideal Customer Profile (ICP) is the north star for your entire company. It’s a sharp, living description of the company—not the person—that gets massive value from your solution and, in turn, provides maximum value back to your business.

This goes way beyond vague descriptions like "mid-size tech companies." A truly powerful ICP is layered with specific data points, creating a multi-dimensional picture of your perfect-fit business.

Firmographics: The Foundational Layer

Think of firmographics as the non-negotiable, quantifiable traits of your ideal company. These are your first-pass filters, the basic criteria that immediately tell you which accounts are worth pursuing and which ones will just waste your time and resources.

You'll want to get specific on a few key data points:

- Company Size: Is your sweet spot based on employee count (e.g., 50-250 employees) or annual revenue (like $10M-$50M ARR)?

- Industry or Niche: Don't just say "manufacturing." Drill down. Is it "aerospace parts manufacturing" or "CPG food and beverage"?

- Geography: Are there specific regions, countries, or even cities where your product has the strongest fit or where your sales team is located?

- Growth Trajectory: Are you after high-growth startups hungry for new tech, or stable, established enterprises? A company's growth rate is a huge tell for its willingness to adopt new solutions.

This data is your starting point. It helps you build an initial list of businesses that at least meet the basic requirements for success with your product.

Technographics: Uncovering Needs Through Tech Stacks

Here's where you get a serious edge. Technographics are all about the specific technologies a company uses. Knowing their tech stack is like having an X-ray of their operational challenges, priorities, and budget allocation.

For instance, if you sell a project management tool that integrates seamlessly with Slack and Salesforce, your prime targets are companies already using both. Their existing investment in those platforms makes your solution a much easier, more logical sell.

Understanding a prospect's tech stack reveals more than just software preferences—it exposes their operational workflows, potential integration gaps, and their overall philosophy on technology adoption.

You can find this data by combing through job postings for required software skills, using tools like BuiltWith, or leveraging sales intelligence platforms.

Psychographics and Behavioral Triggers

While an ICP focuses on the company, it's ultimately driven by human behavior and organizational culture. For B2B, this means digging into a company's mindset and buying signals. Companies that are truly dedicated to personalization, for example, generate 40% more revenue growth than their less-focused peers.

Keep an eye out for these kinds of behavioral triggers:

- Are they hiring for roles your software directly supports?

- Are their key executives publishing articles or speaking at events about a problem you solve?

- Did they just land a new round of funding?

These actions signal that a company isn't just a good fit on paper—they might have an active, urgent need right now.

Once you have a crystal-clear ICP, you can move on to building out the individual buyer personas within those target companies. We've laid out the entire process for that in our guide on using buyer personas to accelerate B2B marketing and sales.

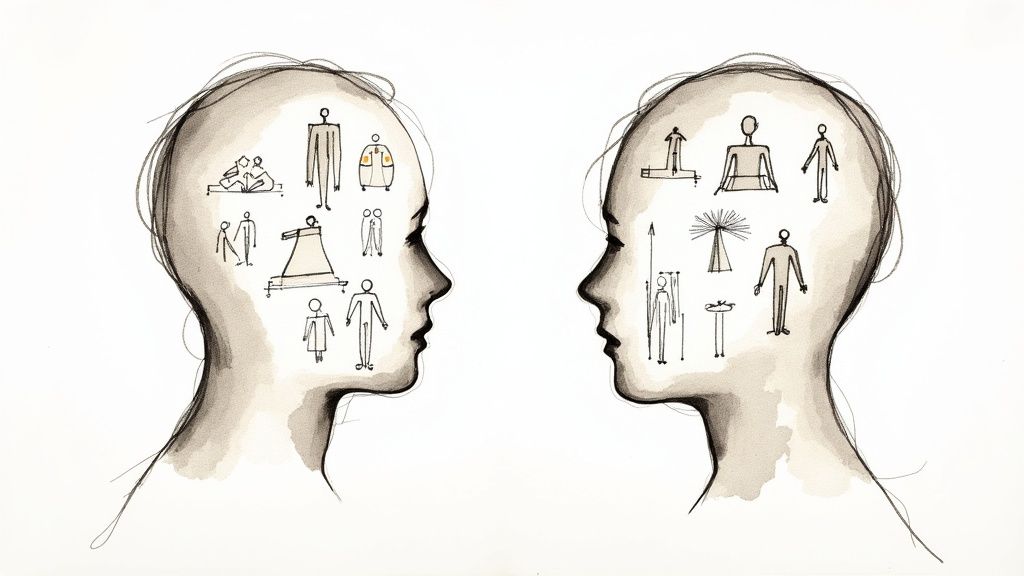

Map the Buying Committee to Find Key Players

In the world of B2B SaaS, a deal is rarely closed with a single handshake. Selling to a business means you’re actually navigating a complex web of people, each with their own motivations, concerns, and level of authority. This group is the buying committee, and understanding its inner workings is absolutely essential to finding your real target market.

A huge—and common—mistake is focusing all your energy on just one person, whether it’s the enthusiastic end-user or a C-level executive. The reality is that the average B2B buying process now involves anywhere from 6 to 10 decision-makers. Ignoring this dynamic is like trying to solve a puzzle with half the pieces missing.

Each person on that committee holds a different key to moving the deal forward—or stopping it dead in its tracks. This is where your target market research has to move from the organizational level (your ICP) down to the human level. You have to figure out who these key players are inside your ideal customer accounts.

Unmasking the Key Roles

Within any buying committee, you'll typically find a recurring cast of characters. Your success hinges on identifying and engaging each one with a message that speaks directly to their role and priorities.

The Champion: This is your internal advocate. They’re the one who sees the true value in your solution and is willing to spend their political capital to push for it. Often, they're the person feeling the pain your product solves most acutely.

The Influencer: This person's technical opinion carries a ton of weight. They might be an IT manager, a senior engineer, or a data analyst. Their job is to vet your solution's security, integration capabilities, and overall technical fit. An Influencer can easily torpedo a deal even if the Champion is your biggest fan.

The Budget Holder: This individual controls the purse strings. They live in a world of ROI, cost-benefit analysis, and making sure the purchase aligns with financial goals. Their main question is always: "Is this a smart investment for us?"

The Decision-Maker: Usually a VP or C-suite executive, this person gives the final "yes" or "no." They rely heavily on the input from the Champion, Influencer, and Budget Holder to make a strategic choice that benefits the entire organization.

Think of it like this: The Champion is the one who desperately wants the new car. The Influencer is the mechanic they bring along to check the engine. The Budget Holder is the one who has to approve the financing, and the Decision-Maker is the one who actually signs the final papers. You have to win over all of them.

Real-World Scenarios and Strategies

Let’s say you're selling a new marketing automation platform. The Marketing Director (your Champion) is thrilled about its potential to improve campaign efficiency. But the Head of IT (an Influencer) is worried about data security and how your platform will integrate with their existing CRM.

If you only talk to the Marketing Director, you’ll be completely blindsided when the IT department blocks the deal. The key is to proactively identify that Influencer and get them the detailed security documentation and a technical demo they need to feel comfortable.

Each role has a unique perspective, and understanding their individual journeys is critical. For a deeper look at this, our guide to B2B customer journey mapping offers a more detailed framework.

So, how do you start? Ask your Champion direct questions like, "Who else will be involved in evaluating this?" or "Whose budget would a purchase like this typically come from?" Then, use tools like LinkedIn to map out the organizational chart and connect the dots. This investigative work is fundamental to knowing who you really need to convince.

Uncover Buying Intent with Behavioral Signals

Knowing your ideal company profile and the key players inside it is a huge step forward. But let's be honest—the accounts that really matter are the ones actively trying to solve a problem right now. This is where buying intent signals become your unfair advantage.

We have to look past basic metrics like website visits. We're talking about tracking meaningful actions that signal genuine, active interest. Think of these as digital breadcrumbs that lead you straight to your next customer.

Decoding Your Own Digital Signals

Your own website and content are absolute goldmines of intent data. You just need to know where to look. When companies matching your ICP take specific actions on your digital properties, they’re essentially raising their hands.

Here are a few key signals to monitor closely:

- Pricing Page Visits: This is one of the strongest indicators you can find. People don't browse B2B pricing pages for fun; they are actively evaluating a potential purchase.

- Case Study Downloads: When a prospect digs into a case study, they're trying to see if you've already solved a similar problem for a business just like theirs. It’s a clear sign of validation-seeking.

- High-Value Content Engagement: Look for actions like webinar registrations, serious use of an ROI calculator, or deep dives into content about your most advanced features.

A single action might just be noise, but a pattern of behavior is a clear signal. If an account from your ICP list has three people from different departments view your pricing page and download a whitepaper in the same week, that’s not a coincidence—it's a massive sales opportunity.

Expanding Your View with Third-Party Data

Your own data is powerful, but it only shows you who is already interacting with you. What about all the companies that are in-market but haven't found you yet? This is where third-party intent data platforms come in.

These services track online research behavior across the web, giving you a much broader view of which businesses are actively researching topics, keywords, or even your direct alternatives. It’s a proactive approach that helps your sales and marketing teams focus their energy where it counts.

Analyzing these wider trends can also uncover surprising market shifts. For example, a focus on supporting locally owned businesses is an important sentiment in the consumer space, as detailed in McKinsey’s 2025 consumer report, and this mindset can influence B2B decisions as well.

By combining these internal and external signals, your teams can stop guessing and start prioritizing outreach to accounts that are showing clear signs of purchase intent. This is a core pillar of modern growth. For a deeper dive into similar strategies, check out our guide on proven tactics for B2B demand generation.

This data-informed method doesn't just improve conversion rates; it dramatically shortens sales cycles, turning a reactive process into a proactive hunt for your next best customer.

Validate Your Target Market Before Scaling

So, you’ve got a solid hypothesis about your target market. That's a great start, but it's just that—a start. Before you pour a small fortune into a full-scale marketing and sales machine, you have to prove your assumptions are grounded in reality. This is where you move from theory to evidence.

Think of this validation loop as your best defense against building a product nobody is willing to pay for. It’s all about stress-testing your ideas with real people and, more importantly, real budgets. This ensures your business is built on a foundation of genuine market demand, not just wishful thinking.

The goal of validation isn’t to be right—it’s to find the truth. Being wrong early is infinitely cheaper than being wrong at scale. It’s an investment in certainty that pays massive dividends.

Conduct Structured Customer Interviews

The fastest way to test your hypothesis? Talk to the businesses you think you’ll be serving. This isn’t about pitching your product; it’s about listening. Your mission is to confirm that the pain points you believe exist are real, urgent, and costly enough for a business to actually solve.

Start by identifying 5-10 prospects who perfectly match your Ideal Customer Profile. Reach out for a "research conversation," never a sales demo.

During these interviews, you want to focus your questions on their world, not your solution. Try questions like these:

- "Can you walk me through how you currently handle [the process your SaaS addresses]?"

- "What are the biggest frustrations or bottlenecks in that process?"

- "Have you tried to solve this before? What happened?"

- "What would a perfect solution look like to you?"

- "What would be the business impact if you could solve this problem effectively?"

Their answers will reveal whether your perceived pain point is a minor annoyance or a critical, budget-worthy business issue. If you find they aren’t actively looking for a solution, your market might not be as ready as you thought.

Run Small-Scale Pilot Programs

Once your interviews suggest you're on the right track, it’s time to test their willingness to pull out a credit card. A pilot program or a small, targeted campaign is the perfect next step. This isn't about mass acquisition; it's about controlled experimentation.

For instance, you could run a highly targeted LinkedIn ad campaign aimed at a micro-segment of your ICP. Send them to a simple landing page that clearly outlines your value proposition and asks for a small commitment, like signing up for a paid pilot or a limited-time offer.

This approach lets you test two critical things at once:

- Messaging Resonance: Does your core value proposition actually grab their attention and compel them to click?

- Willingness to Pay: Are they willing to put money down, even a small amount, to solve their problem?

The data you get from these small-scale tests is pure gold. It provides concrete evidence of whether you have a viable business on your hands. Getting this right is a major step toward finding product-market fit for your B2B startup. This validation loop—interviewing, testing, and refining—is what separates thriving companies from those that never quite get off the ground.

Common Questions on Defining Your Target Market

As you start to dig into your target market, a few common (and very important) questions always seem to pop up. Let's tackle them head-on, based on what we've seen work for countless B2B companies.

How is B2B Market Research Different From B2C?

The simplest way to put it is this: B2C marketing often targets a single person's emotions and immediate wants. B2B market research, on the other hand, is about understanding the complex machinery of an entire organization.

In B2B, you're almost never selling to just one individual. Decisions are made by a buying committee, where each person has a different set of priorities—from measurable ROI and security to long-term operational efficiency. Your research has to go much deeper than basic demographics, digging into firmographics (like company revenue and industry) and technographics (their current software stack). It’s a team sport, not a solo purchase.

A B2C sale convinces a person. A B2B sale convinces an organization. The evidence, stakeholders, and sales cycle are fundamentally different, demanding a much more analytical and strategic approach to defining your market.

What Are The Best Free Tools To Start My Research?

You absolutely do not need a huge budget to get meaningful insights. In fact, some of the most valuable data is available for free if you know where to look.

Here are a few places to start gathering intelligence without spending a dime:

- LinkedIn: Go beyond just looking at company pages. Dive into the job descriptions of roles at your target accounts. These descriptions are a goldmine, often revealing the exact software they use (technographics) and the biggest challenges they're trying to solve.

- Your Own Customer Data: Your best existing customers are your most valuable research asset. Pull a list of your top 10 happiest, most successful customers and find the common threads. What industry are they in? What’s their company size? What specific problem did they hire you to solve? This is your starting point for a data-backed hypothesis.

- Industry Forums and Review Sites: Professionals don't hold back on platforms like G2, Capterra, or niche industry forums. They openly discuss their challenges, what they love and hate about current tools, and what they wish they had. Monitoring these conversations is like having a direct line into your market's pain points.

These resources will give you more than enough raw material to build a strong initial draft of your ideal customer profile.

How Often Should I Revisit My Target Market Definition?

Think of your target market definition not as a stone tablet, but as a living, breathing guide. It's something you create, use, and then refine as you learn more. Sticking to an outdated profile is a recipe for stalled growth.

As a general rule, you should formally review your Ideal Customer Profile at least once a year. However, some events should trigger an immediate re-evaluation, no matter when you last looked at it.

These triggers include:

- A major product update that introduces completely new use cases.

- A significant shift in the economic or business environment.

- A noticeable drop in your sales win rates or a sudden lengthening of your sales cycle.

These are all signals that your initial assumptions might no longer hold true. Continuously challenging and validating your target market is what keeps your entire go-to-market strategy sharp, effective, and firmly grounded in reality.

Defining and validating your target market is the most important work you can do to set your B2B business up for success. If you need an experienced partner to build a clear brand identity and a data-driven growth strategy, Big Moves Marketing offers fractional CMO services to guide you. Find out how we can accelerate your growth.

%20-%20Alternate.svg)

%20-%20white.svg)